Want to see a very slick website update? Check out the new page for Orion Advisor Services, LLC, just launched yesterday. Tip: There’s an easter egg or two on the site. Can you find them?

Also, don’t miss this month’s Morningstar Advisor column, One Tool With Six-Figure Savings Potential.

Here are this week’s stories of interest:

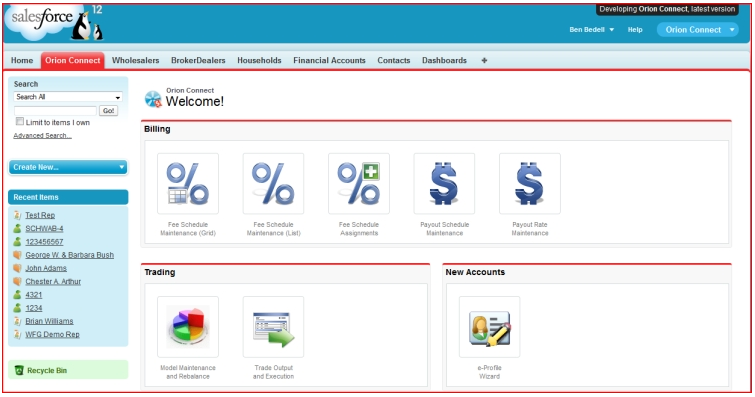

Orion Releases Orion Connect On Salesforce.com’s AppExchange, The App Marketplace For The Social Enterprise from Reuters

[I told you about Orion Connect back in April. Here’s the official announcement from the company, which is a strategy I believe will continue to accelerate the prevalence of salesforce.com in most adviser offices.] Orion Advisor Services, LLC, a premier portfolio accounting service provider, today announced that its new Orion Connect application is available on salesforce.com’s AppExchange, the app marketplace for the social enterprise.

Advisor Websites Turns Ten and Launches New Website from AdvisorWebsites.com

[When I interviewed Advisor Websites Co-founder and CEO Bart Wisniowski, I had no idea the company was about to turn ten years old. In recognition of this milestone, the company is offering discounted pricing if you sign up for a new website by the end of June. Strike while the iron is hot, right? (I do not get paid for any of this; I just like the quality of work they deliver for advisers)] Advisor Websites, a leading web-based software used by financial professionals to create and manage compliant websites, turned 10 this week and is pleased to mark this special event with the launch of its newly redesigned website.

Account Aggregation Would Help Financial Advisors Provide Better Advice, Reveals Fiserv Survey from MarketWatch.com

[Clearly you have a lot to gain by embracing account aggregation in your business. You see nearly all of your clients’ investable assets, not just those held at your custodian, and you can increase revenue if you include held-away assets in your billing and service models. Most of you already know that aggregation isn’t widely used, with 3 of 4 surveyed advisers acknowledging they don’t, but I just wish data from Fiserv’s CashEdge Divison was reconciliation-ready out of the box.] Fiserv, Inc., a leading global provider of financial services technology solutions, today announced the results of its annual financial advisor survey. The survey revealed that financial advisors currently lack access to the aggregated account data needed to provide them with a complete view of their clients’ finances, which could impact advisors’ ability to provide holistic guidance.

The financial adviser’s quick guide to social media archiving from InvestmentNews

[Need a quick roundup of six providers of social media archiving? Here’s a succinct list. However, Smarsh deserves a mention as they’re #1 among broker-dealers according to a recent survey by Beacon Strategies] Social media is an incredibly fun and effective way to engage with millions of people online. Along with the excitement, however, is the perceived buzz kill—FINRA and SEC compliance standards.