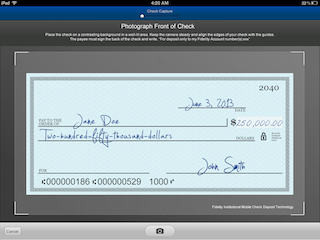

WealthCentral Mobile from Fidelity now allows advisers to snap photos of checks and deposit them into clients’ eligible Fidelity accounts

Weeks after LPL introduced remote check deposit in its app, Fidelity becomes the first custodian to offer the functionality to its advisers.

Fidelity Investments® introduced remote check deposit support for financial advisers with the latest update to the Fidelity WealthCentral Mobile app.

Fidelity WealthCentral Mobile has been available for iOS and Android devices for roughly two-and-a-half years, and its latest update introduces the remote check deposit feature widely popular among retail banks and financial institutions.

A First for RIAs

Snap photos of checks and deposit them using the Fidelity WealthCentral Mobile app

Fidelity, the third-largest custodian by number of advisers, is not the first institution to offer remote check deposit capabilities to advisers. That distinction is awarded to LPL Financial, which released a new version of LPL Mobile in conjunction with its LPL Focus 2013 conference last month in San Diego (see LPL Financial Unveils Enhancements to Technology Platform at Annual Financial Advisor Conference).

However, Fidelity does get recognition as being the first institutional custodian for independent RIAs to offer remote check deposit to its advisers.

Prior to the general release of remote check deposit to the adviser community, Fidelity worked with about a dozen firms in a pilot period, covering a wide range of business models and services.

“Natural Progression”

“We see this as a natural progression in the mobile space.” Ed O’Brien

“We see this [remote check deposit] as a natural progression in the mobile space,” said Ed O’Brien, head of technology for Fidelity Institutional Wealth Services, adding, “further enhancing our technology as we support the ‘anywhere advisor.'”

But advisers eager to download Fidelity WealthCentral Mobile and start depositing client checks right away with their mobile device will need to be patient.

Enrollment Required

Fidelity does have a qualification process for any adviser interested in becoming eligible to use remote check deposit. Advisers must first complete a remote deposit agreement and update their internal policies and procedures with appropriate steps for remote deposit.

The qualification process can take anywhere from one to six weeks, depending on the environment at the requesting firm. Remote deposit can be used by independent RIAs all the way up to institutional clients who clear under National Financial, which is the reason for such a wide range in implementation time.

“Each adviser is unique, so we want to first make sure we understand their needs and processes to ensure a successful deployment,” said O’Brien.

Deposit Limits

Deposits made through the mobile app are limited to $250,000 per check, and the same $250,000 limit applies to total daily deposits per account, which should cover a significant portion of checks received by advisers.

In general, there are no specific account restrictions for remote check deposit. Any account with deposit privileges, whether it’s brokerage, retirement, college savings, or trust, can accept deposits via mobile devices.

For all the details regarding the updates to WealthCentral Mobile, read the press release from Fidelity Investments.