On today’s broadcast, ransomware strikes again, updates on LPL Financial’s automated investment service, and Morningstar releases sustainability ratings for mutual funds.

So get ready, FPPad Bits and Bytes begins now!

(WatchFPPad Bits and Bytes on YouTube)

Today’s episode is brought to you by IMPLEMENT NOW, the independent advisor’s Practice Management Virtual Summit hosted by Kristin Harad broadcasting online March 14th to the 18th. When you register, you’ll get access to the interviews and bonus material from 25 industry thought leaders who share how-to advice you can use right away to improve your practice. And, when you register by March 13th, your participation will count toward scholarships for the Child Mind Institute’s Brave Buddies program for anxious children.

Find all the details for this high-impact online event by visiting fppad.com/implementnow

Stay on Guard Against Cyberattacks from ThinkAdvisor.com,

2 New Members Of The Ransomware Family That Are Already Wreaking Havoc! from True North Networks, and

The Pentagon wants you to hack its network for real from TheNextWeb

This week’s top story covers cybersecurity, as Dan Skiles, president of Shareholders Service Group, urges advisers to rethink their approach to keeping the firm safe from attacks. Skiles’ column is timely for two reasons: First, new ransomware called Locky is making the rounds, as True North Networks shared that they are helping one company restore critical data after getting infected by Locky ransomware.

And second, I don’t know if you heard, but this week the Pentagon, probably one of the most well-defended organizations on Earth, announced their own “Hack the Pentagon” program to pay hackers a bounty for finding vulnerabilities! If the Pentagon needs cybersecurity help, I think think it’s safe to say you probably need it, too.

So, where do you begin? I asked one expert to find out:

[Michelle Jacko] Advisors should begin with conducting a risk assessment, doing an inventory of what their technology uses are. Take a look at vulnerabilities by hiring an IT security specialist. Look at internal controls, develop those policies and procedures, and finally, really concentrate on user awareness training, which often is the beginning of where problems start.

If you want cybersecurity help from an outside partner, I connected with Itegria and External IT to find out what’s new:

[Robert Madi] Bill, we’re really excited to announce AdvisorGuard which is a cybersecurity specific solution designed exclusively for RIAs. As an expert in the RIA space, ITEGRIA understands how important cybersecurity is for advisors and how top of mind it is. We’re really excited about it and looking forward to making a huge impact in the RIA space.

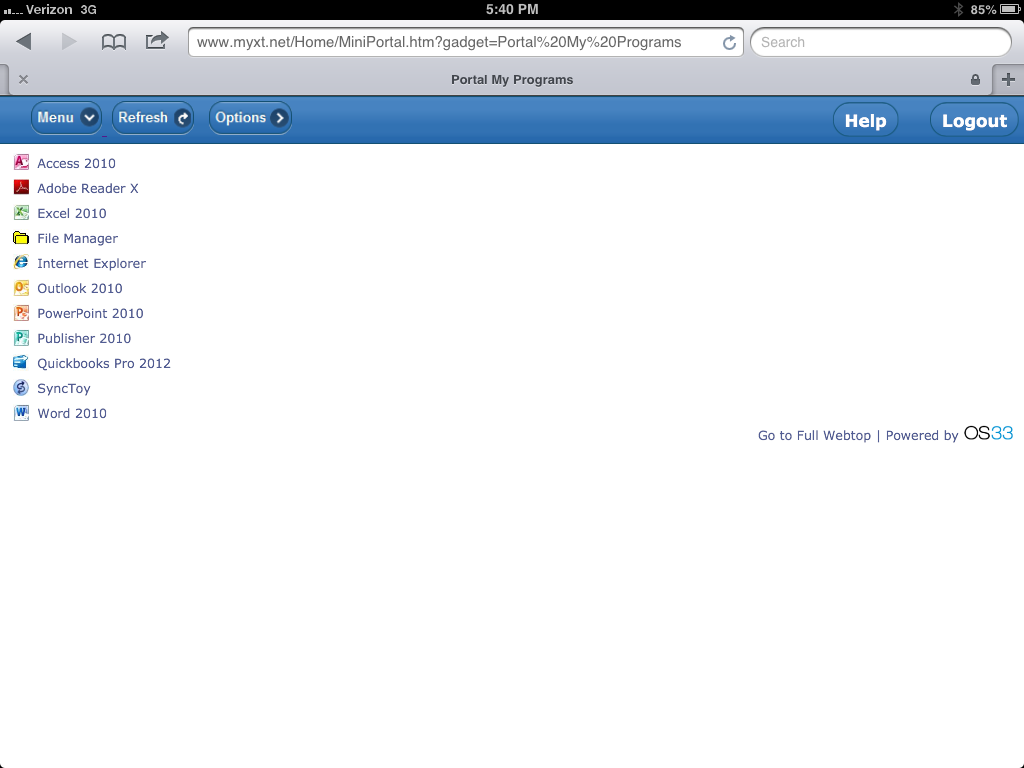

[Sam Attias] We’ve released new features, a lot of them have to do with auditing, monitoring of what people are doing within our system with all their applications. We can monitor devices, we can also… a new secure sign on that we’ve come out with that has a lot of exciting features, one of them being for all your web-based applications like a Tamarac or an Orion, Salesforce, you can set the logins and passwords for everybody in your firm and they wouldn’t know what they are.

I think it’s safe to say that it’s time to stop kicking the cybersecurity can down the road and engage a provider that can help you protect your firm from attacks. For more information, be sure to head over to fppad.com/181 for the links to this week’s top stories.] Cybersecurity should be on every advisor’s mind. The unfortunate byproduct of advances in technology is that cybercriminals have new opportunities to commit their crimes.

LPL Expects to Launch Robo-Advisor This Year from ThinkAdvisor.com

[Next is an update from LPL Financial, as this week Bill Morrisey, the company’s head of business development, told ThinkAdvisor that their automated investment service for use by advisors is expected to roll out later this year.

Ok, so let’s rewind to episode 169 for a brief refresher:

No details on pricing or even a name for the solution were provided, but LPL president Dan Arnold did say that a pilot program with about 20 advisors will be begin in the next few months.

Morrisey didn’t comment on the pilot phase, and there still are no details on a fee schedule, minimum requirements, or even a name for the solution, but Morrisey did say that all investors would qualify for the service, so I expect there to be really low or no account minimum when the solution is officially released.] Seven months ago, at its annual conference, LPL announced its intention to launch a robo-advisory service, starting with a pilot program. Now the firm’s head of business development tells ThinkAdvisor that LPL expects to add the service this year.

Morningstar Releases Sustainability Rating for 20,000 Funds from Morningstar.com

[And wrapping up this week’s broadcast is news from Morningstar, as the investment research company released sustainability ratings for over 20,000 mutual funds. If you use Morningstar Direct or Morningstar Office in your business, you can now view the sustainability ratings from within your application, and the company anticipates the ratings will be introduced into Morningstar Advisor Workstation as well as the Morningtar.com websites in the coming weeks.

More and more emerging investors not only want to save for their future, they also want their investments allocated to companies with high environmental, social, and governance factors, or ESG.

So I spy a differentiation opportunity, because the consumer-facing automated investing services don’t give customers the option of allocating their money based on ESG factors. You, on the other hand, can now offer that option.] Investors will now be able to evaluate funds based on environmental, social and governance (ESG) factors with Morningstar’s new sustainability rating for funds.

Here are stories that didn’t make this week’s broadcast:

Personal Capital Surpasses $2 Billion in Assets from PRNewswire

Personal Capital, the leading digital advice firm, today announced it has achieved $2 billion in assets under management (AUM), with one-third coming from clients with over $1 million in assets at Personal Capital. The average AUM per client is now $300,000.

Orchestrate acquires Sagacious from BusinessRecord.com

Orchestrate LLC, a West Des Moines applications, services and support firm serving financial services companies on Salesforce.com, has agreed to acquire Sagacious Inc., also a West Des Moines firm.

NAIFA Selects Junxure as a Partner CRM Provider for Its 43,000 Members from PRNewswire.com

Junxure, an industry-leading CRM solutions and technology firm for financial advisors, today announced its partnership with the National Association of Insurance and Financial Advisors (NAIFA), which represents the interests of insurance professionals and financial advisors through legislative and regulatory advocacy and ongoing education.

![Ryan Terwedo, founder and CEO of CloudRIA: "Depending on how they are providing the [virtual desktop] window, the user experience is not great."](http://fppad.com/wp-content/uploads/2013/02/CloudRIA-300x170.png)