On today’s broadcast, iPhone and iPad users on high alert; what you need to do right now to fix a huge security flaw, how Schwab Advisor Services plans to give thousands of advisors a presence in the popular app stores, and what’s the next hot technology you might see coming from the industry’s largest independent broker-dealer?

So get ready, FPPad Bits and Bytes begins now.

(Watch FPPad Bits and Bytes on YouTube)

Today’s episode is brought to you by Redtail Technology, providers of cloud-based CRM for financial professionals since 2003.

Check out their popular CRM, document imaging, and complaint email solutions and sign up for a 30-day free trial by visiting fppad.com/redtail.

Behind iPhone’s Critical Security Bug, a Single Bad ‘Goto’ from Wired, and

Apple Patches Critical OS X ‘Gotofail’ Security Hole from PC Magazine

[This week’s top story is for all of you who use iPhones and iPads in your business. In case you haven’t heard, Apple quietly rolled out a new update to iOS this week to patch a critical flaw in the way secure Internet connections are handled.

It’s been dubbed the “gotofail” flaw, as the operating system’s source code had an inadvertent goto command, essentially bypassing the final steps in the security authentication process.

So what you need to do right now is to turn on your device, open the Settings app, tap General, and then tap Software Update to start the download process. The same bug also affects Mac users, so be sure to perform a Software Update on your Mac to patch this security hole.] Like everything else on the iPhone, the critical crypto flaw announced in iOS 7 yesterday turns out to be a study in simplicity and elegant design: a single spurious “goto” in one part of Apple’s authentication code that accidentally bypasses the rest of it.

Schwab OpenView Mobile launches, allows RIAs to create branded mobile apps for iOS and Android from FPPad

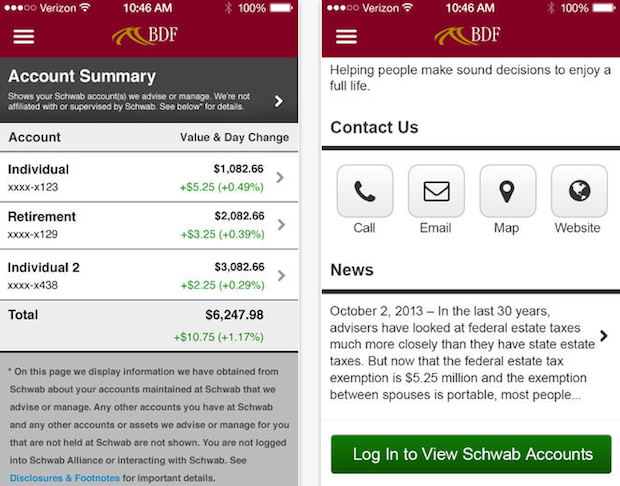

[Next up is another story about mobile devices, only this one comes from Schwab Advisor Services. In a press release this week, Schwab announced that it officially rolled out Schwab OpenView Mobile, a service that allows advisors to publish native mobile apps branded for their business. Schwab OpenView Mobile lets advisors perform limited customization of things like logos, contact details, and color schemes and publish the app in the iTunes App Store as well as Google Play.

But Schwab isn’t the first to offer custom branded apps for advisors, as both Orion Advisor Services and Trust Company of America have both been offering this service to their clients for several years at no additional charge. The Faulkner Media Group also publishes branded mobile apps for advisors at a reasonable price.

But for a cost of of $5,000 up front plus $2,000 in annual maintenance, Schwab OpenView Mobile might prove to be a bit too expensive relative to the other third party app solutions currently on the market. I’ll come back in a few months to report on the overall adoption of OpenView Mobile by Schwab’s advisors, so stay tuned.] Schwab OpenView Mobile officially launches, allowing RIAs to publish branded mobile apps to the iTunes App Store and Google Play

LPL Financial to deploy Microsoft Lync for enterprise messaging from Twitter

[And finally, wrapping up this week’s broadcast is a little inside information on how LPL Financial hopes to make its advisors a bit more efficient when collaborating with the home office. According to my sources, aka a tweet from Jamie Cox, LPL will soon be deploying an instant messaging and video chat service from Microsoft called Lync.

Now I know several RIAs have been experimenting with collaboration platforms like Yammer, Google Chat, and Salesforce Chatter, but this is the first I’ve heard of an independent broker’s plans to roll out an enterprise-wide messaging app. Retail pricing for Lync is $2 per user per month, but I don’t have details on what the final cost will be to LPL representatives, if any.

While the apps might seem a little funky at first, it’s clear that realtime messaging and collaboration is really gaining momentum in the enterprise, so if you aren’t at least experimenting with some of these apps, you might want to put them on your technology roadmap for this year.]

@BillWinterberg @LPL will eventually r/o Lync to advisers—but no small office is likely to choose lync IMO when iMessage/gchat are free

— Jamie Cox (@jamesacoxiii) February 25, 2014