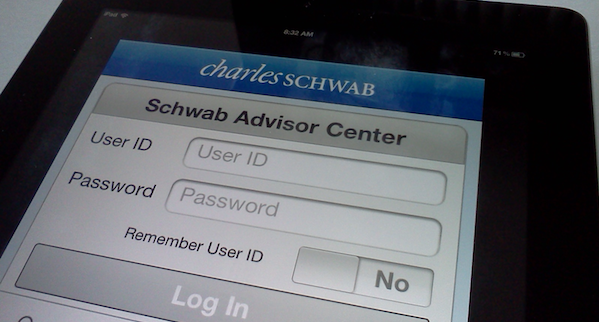

Schwab Advisor Services’ first iPhone app lacks functionality offered by the competition, but opportunity remains for the leading custodian to catch up

In last week’s Bits & Bytes, you read about Schwab Advisor Services’ new iPhone app release. RIABiz posted this article shortly after the release with comments and perspective. The gist is Schwab’s 30,000 users across 7,000 firms can use Schwab Advisor Center on an iPhone to check client account balances, transactions, and positions in version 1.0.

Yesterday I spoke with Steve Hirsch, vice president of institutional web services for Charles Schwab, about the company’s decision to offer basic functionality in its first mobile app for financial advisers.

“We conducted extensive client research, asking over 400 [adviser] clients to rank the features and functions they would use most in a mobile phone app,” said Hirsch. “Out of a selection of five features, 66% of them chose access to account balances, transactions, and positions.”

Choices for other functionality selections included access to account alerts and notifications, market news and information, move money capabilities, and trading.

Playing it safe

Schwab’s entry into the mobile app scene is long overdue, as competing custodians have offered mobile apps to advisers for well over a year. Two of them have even developed apps exclusively for iPad that offer features such as streaming market news (see Exclusive look at Veo® Mobile app updates for iPad from TD Ameritrade Institutional’s Jon Patullo) and trading in client accounts (see Fidelity WealthCentral Mobile now available for iPad).

So if you’re Schwab, there are two ways to enter this market.

First, you can survey what the competition is doing, match them on a feature-by-feature basis, and then raise the bar on functionality by developing features nobody else has. Remember Steve Jobs and the three new product launches of “a widescreen iPod, a revolutionary mobile phone, and a breakthrough Internet communications device?”

Or second, you can ask users what they want, pick the top response, and build to that specification (The “we want a faster horse” scenario).

Schwab, with version 1.0, selected the latter.

Dipping a toe in the water

But to Schwab’s credit, they’re far from finished with the rollout of their mobile strategy. It’s just that with version 1.0 of Schwab Advisor Center, Schwab delivered only what advisers said was their number one desired feature.

Where’s the innovation in that strategy?

I challenged Hirsch to get him to divulge a bit more about Schwab’s future in mobile. Clearly, rolling out a basic iPhone app first was an easy win.

“We saw great utility in mobile phone devices as a vehicle for quick access to client accounts,” said Hirsch. “Advisers and consumers carry their phone everywhere 24×7, so we felt it was a great place to start by supporting immediate account access using devices widely held across a large base of users.”

Mobile potential

And on plans for the iPad app, expected by the end of 2012?

“The iPad app will have a different tenet than the iPhone app,” he said. “We’ll optimize what we present, starting with functionality similar to the iPhone app, but expand it well beyond that to take advantage of bigger screen real estate.”

Hirsch acknowledged that the app is anticipated to deliver much more functionality that what is offered today.

“Clearly, client reporting is priority for us, as well adding performance and asset holding features that advisors will use in client meetings and presentations.”

When asked about the ability to use the iPad in the account application process, including e-signature capabilities, Hirsch was guarded.

“These features are in Schwab’s domain, and we see tremendous potential here.” he said.