I’m flying with the family to Portland, Oregon tomorrow for business and pleasure. I’ll be speaking to the FPA of Oregon & SW Washington on Wednesday and visiting with a technology provider on Thursday. Outside of those commitments we’ll be touring the natural wonders of Oregon and relishing in the temperate summer weather (in contrast to 14 days of 100+ degree temperatures we’ve experienced here in Dallas!).

I’m flying with the family to Portland, Oregon tomorrow for business and pleasure. I’ll be speaking to the FPA of Oregon & SW Washington on Wednesday and visiting with a technology provider on Thursday. Outside of those commitments we’ll be touring the natural wonders of Oregon and relishing in the temperate summer weather (in contrast to 14 days of 100+ degree temperatures we’ve experienced here in Dallas!).

[Photo used under Creative Commons from camknows]

Now on to this week’s stories of interest:

Interactive Advisory Software joins the horse race with VC funding, a new look, and new CEO from RIABiz.com

[You’ve probably never heard of IAS unless you’re a user. They ranked far below competing platforms in the 2010 Financial Planning Technology Survey, so will their refresh and new marketing initiatives result in larger adoption by RIAs?] Based out of Atlanta, Ga., Interactive Advisory Software is stepping out of its “hidden gem” history with new investment, a new CEO, and a brand new look.

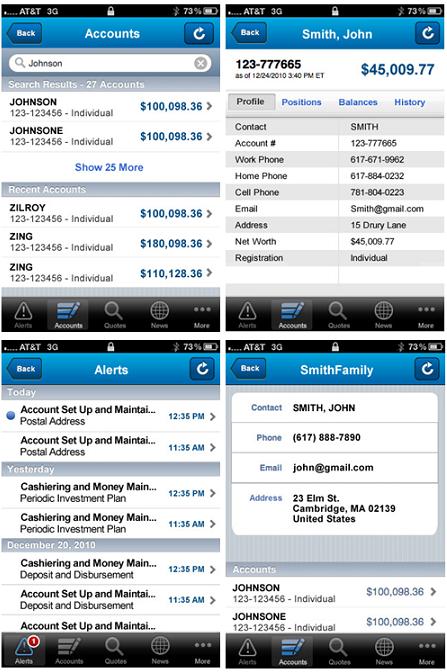

Fidelity adds trading to WealthCentral Mobile from InvestmentNews.com

[I suspect advisers are not too inclined to submit trades in client accounts from mobile devices. But from a marketing perspective, saying your app supports mobile trading is a nice checkbox in the functionality matrix] Financial advisers on the WealthCentral platform can now add trading to the list of things they can do from their iPhones and later model Android smart phones.

Social Media Archiving Meets the Back Office – a Cloud Computing Solution for Registered Investment Advisors from Arkovi.com

[Anyone heard of WinWeb? It’s new to me, and I have no clue how well they serve the adviser marketplace.] Arkovi and WinWeb Announce Integrated Partnership Bringing CRM, Social Media Archiving and Operations into One Solution for Registered Investments Advisors.

Orion Welcomes Advance Capital from PRNewswire.com

[Orion, the popular web-based portfolio accounting and service bureau, keeps gaining users and assets reconciled through their platform] Orion Advisor Services, LLC, a comprehensive portfolio accounting service bureau, is pleased to welcome new client Advance Capital Management, Inc., a Broker-Dealer and Registered Investment Advisor with almost $2 billion in assets under management including its own proprietary funds. Advance Capital Management joins a rapidly expanding roster of premier investment firms to utilize Orion’s innovative back-office solutions.

Read this month’s column for Morningstar Advisor, Save Time, Reduce Errors with Text Expanders. You might benefit tremendously from using tools like TextExpander and PhraseExpress.

Read this month’s column for Morningstar Advisor, Save Time, Reduce Errors with Text Expanders. You might benefit tremendously from using tools like TextExpander and PhraseExpress.

And if you’re convinced your clients aren’t texting, you need to read my post this week for Blueleaf, Your Clients Are Leaving You In The Dust.

FPPad headquarters has temporarily relocated to the mid-Atlantic area for the holidays. Our official consulting work for 2010 is complete, and we look forward to serving new and existing clients in 2011.

FPPad headquarters has temporarily relocated to the mid-Atlantic area for the holidays. Our official consulting work for 2010 is complete, and we look forward to serving new and existing clients in 2011. Happy Halloween! This week’s edition of Bits and Bytes is full of all treats and no tricks.

Happy Halloween! This week’s edition of Bits and Bytes is full of all treats and no tricks.