Financial Advisor Magazine is reporting today that the CFP® Certification requirements are going to “get tougher.” I read through the brief article but I didn’t get the sense that the obtaining and maintaining the certification is necessarily going to become more difficult.

Financial Advisor Magazine is reporting today that the CFP® Certification requirements are going to “get tougher.” I read through the brief article but I didn’t get the sense that the obtaining and maintaining the certification is necessarily going to become more difficult.

From the article, Dr. Ivan C. Roten, CFP®, director of the Financial Planning Center at Appalachian State University had this to say:

Since education is one of the four cornerstones of the certification process, we intend to provide an unshakeable foundation for CFP certificants to apply their financial planning knowledge most effectively to their clients’ ever-changing financial situations.

There is no question that establishing standards, particularly educational, can be like shooting a moving target. I can only imagine that the Individual Income Tax and the Estate Planning topics pose most of the challenges to the CFP Board in defining appropriate educational standards. Year after year, these topics introduce new nuances and subtleties, no thanks in part to Congress.

Is It Really Tougher?

But where did Financial Advisor get the notion that the standards were becoming tougher? Is it because too many people are passing the exam? Are there too many existing CFP Certificants so the Board feels compelled to tighten requirements?

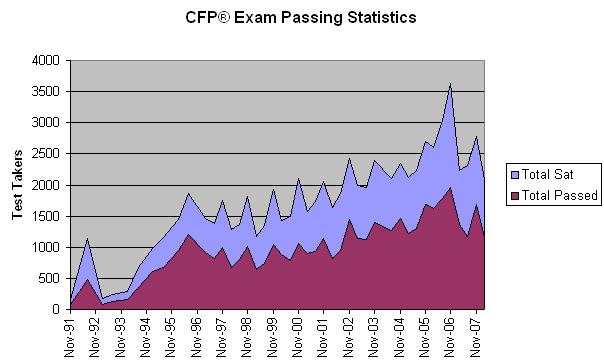

I compiled the last 14-15 years of passing rate data avaialble on the CFP Board’s website into a chart to see if any significant trends emerge (strictly for those that sit for the exam). Below are the results:

I don’t know about you, but the pass rate seems to have held relatively steady for many years. I have heard many times that the Board may adjust the difficulty of the exam based on the passing rate of prior exams in order to keep the pass rate consistent. The one significant spike in test takers appears just prior to the enforcement of a Bachelors Degree requirement after July 2006.

You make the call for yourself. Are the requirements to certification really getting tougher, or are they being adjusted to properly reflect the rising complexity faced by financial planners today? Let us not forget that over the last few years, planners have seen an explosion of new topics to understand, including structured investment vehicles (SIVs), ETFs, 130/30 mutual funds, education tax credits, FAFSA factors, and many more.

It’s about time the CFP Board updated the requirements and standards to ensure the best level of service to financial planning clients. If the requirements are viewed as “tougher,” I welcome it, as it further defines the minimum standard of care for all potential consumers of financial planning.