Bernie Clark, executive vice president of Schwab Advisor Services, kicks off IMPACT 2013 in Washington, D.C.

Schwab IMPACT 2013 kicked off its pinnacle event in Washington, D.C. this year with a big focus on the technology trends sure to change the financial services industry in the foreseeable future.

Here are the most important technology announcements provided by various members of the executive team inside Schwab Advisor Services.

Project PM2 Coming

Likely the most intriguing announcement from Neesha Hathi, SVP of Advisor Technology Solutions is the preview of a new portfolio management software platform called Project PM2 (“PM Squared”).

Neesha Hathi, senior vice president of Advisor Technology Solutions, shares the latest on Schwab’s technology offerings at IMPACT 2013.

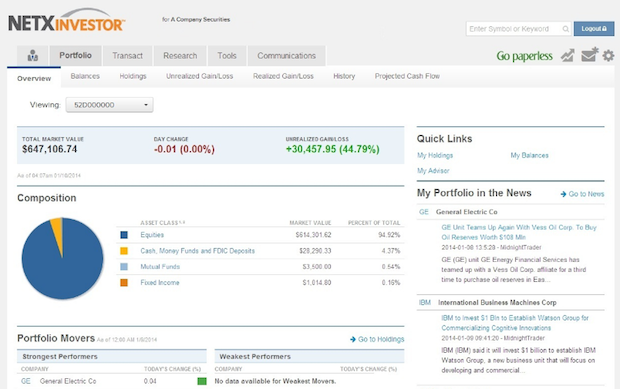

From a video shown at Schwab IMPACT, the preview of PM2 featured a tile-like interface reminiscent of Windows 8. Project PM2 will offer proactive alerts for events like new account funding, trading reports, and revenue metrics.

PM2 will be a cloud-based solution offering direct integration to Schwab data feeds. Reports and presentations offer dynamic capabilities and will support one-step publishing to a variety of client delivery mechanisms.

PM2 to be Multi-Custodial

In a later interview with Brian Shenson, vice president of Advisor Technology solutions, he said the roadmap for PM2 includes multi-custodial data support as well as the potential integration of account aggregation software.

Shenson added that Schwab Advisor Services already has long-standing relationships with providers like ByAllAccounts and CashEdge from FiServ.

Details on pricing and availability for PM2 were not announced at IMPACT.

Schwab OpenView Mobile

Hathi also announced a current pilot program underway to provide affiliated advisors with a branded mobile app that clients can use to interface with their advisor.

Schwab OpenView Mobile is the official program, and Hathi explained that clients can use the branded app to view real-time account data and review their advisor’s contact information.

Schwab OpenView Mobile will be available for a nominal fee which was not disclosed during the Schwab IMPACT breakout session.

Reinvented Wire Requests; DocuSign Integration in Schwab Alliance

Naureen Hassan, senior vice president, Client Experience, shares the latest on Schwab’s technology offerings at IMPACT 2013.

Naureen Hassan, SVP of Client Experience revealed that in an average quarter, Schwab manually verifies over 240,000 signatures across a variety of forms. Clearly Schwab recognizes the ability to increase operational efficiency here with the adoption of electronic signature support.

Hassan announced two pending initiatives. First, wire requests will be “completely reinvented,” as advisors can initiate wire requests via Schwab Advisor Center. Upon submission, clients will actually receive alerts on their mobile phone, and then they can log in to a Schwab app and approve the wire request on the spot.

This overhauled wire request process is aimed to combat fraud and theft in the industry due to a significant rise in client spoofing (see: Client spoofing strikes again, RIA loses $290,000 of client funds)

Second, Hassan announced that DocuSign is currently in a pilot program and will soon be completely integrated in the Schwab Alliance system. Details on when DocuSign will be formally introduced for all Schwab advisors were not disclosed.

MoneyGuidePro Now Part of Integrated Office

Brian Shenson, vice president, Advisor Technology Solutions, shares the latest on Schwab’s technology offerings at IMPACT 2013.

Brian Shenson, VP of Advisor Technology Solutions was the next to take the stage and provide updates on the suite of Schwab OpenView solutions: Gateway, Integrated Office, Workflow Library, and MarketSquare.

Of most relevance is the addition of financial planning software integrations to Schwab OpenView Integrated Office™ platform. The first integration is with PIEtech to integrate MoneyGuide Pro financial planning software. NaviPlan from Zywave was also mentioned as an integration coming soon to Integrated Office.

MarketSquare Update

If you recall last year, Schwab announced the introduction of Schwab OpenView MarketSqaure, a review website consisting of advisor-submitted feedback on technology vendors and providers.

At this year’s IMPACT conference, Hathi said that over 70 providers have the potential to be listed in OpenView MarketSquare, but only 34 of them have a sufficient number of reviews to be publicly listed in the resource.

Hathi urged advisors in the audience to continue to submit their reviews of tools and services they use so MarketSquare can increase the number of providers present in the website.

34 have reviews.

All photos by Billy Cole/Orange Photography for Charles Schwab. Used with permission.