On today’s broadcast, the Office of the Future has arrived. Find out what technology you should buy to be an advisor on the leading edge. Cybersecurity enforcement is coming from the SEC. How will you prepare your firm for this new round of exams? And, retirement illustrations get distilled down to two variables. How one company’s simplified tool can help clients make better investment choices, all in real time.

So get ready, FPPad Bits and Bytes begins now!

(Watch FPPad Bits and Bytes on YouTube)

Today’s episode is brought to you by Laserfiche, a leading document management provider to financial advisors.

Laserfiche helps increase business value by automating client onboarding and document filing processes, all while supporting regulatory compliance. Download a free copy of their ROI for RIAs white paper by visiting fppad.com/laserfiche

Here are this week’s stories of interest:

Fidelity® Opens New Office of the Future to Show Financial Advisors First-Hand How to Embrace Technology from BusinessWire

Launch the virtual tour of the Office of the Future at Fidelity.com

[This week’s lead story comes from Fidelity Investments, as the company unveiled a radical approach to the advisor’s workplace called the Office of the Future. Fidelity’s Office of the Future is actually a real place you can visit at the company’s campus in Smithfield, Rhode Island.

If you can’t visit the office in person, Fidelity provides a 360-degree virtual tour online, where you can view technology that emphasizes seven trends relevant to advisors, including pervasive video, big data, gamification, and more.

But a part of me feels that the Office of the Future label is bit of a misnomer, as you can buy just about every piece of equipment installed in the Office of the Future today. Nevertheless, if you updated your technology with the kinds of tools and devices seen in Fidelity’s example, I think you’ll have a good chance of attracting new clients that have increased expectations about their advisor’s technology and overall service experience.] Fidelity Institutional, the division of Fidelity Investments® that provides clearing, custody and investment management products to registered investment advisors (RIAs), banks, broker-dealers and family offices, today announced the opening of the Office of the Future on its Smithfield, Rhode Island campus.

U.S. Securities and Exchange Commission’s Office of Compliance Inspections and Examinations Cybersecurity Initiative from SEC.gov

[Now as all financial professionals use more technology in their businesses, the SEC is ramping up its oversight of the risks of all this technology through enhanced cybersecurity examinations.

Two weeks ago, the SEC released an extensive document covering dozens of items examiners may request when auditing the cybersecurity policies and procedures of a financial services firm, and that includes SEC-registered investment advisers.

Based on its list of requests, the SEC expects you to have a written security information policy, an inventory of hardware devices and software applications used in your business, details on when and how you conduct risk assessments, and a whole lot more.

It’s clear that enforcement regarding cybersecurity is about to get a lot tougher, which I feel is appropriate given the responsibility you have to keep your clients’ personal and financial account information safe from attacks.

So I recommend that whoever is responsible for addressing security in your firm review the nearly 30 individual items in the SEC’s sample request list and update your policies and procedures accordingly, and do it sooner rather than later.] OCIE is issuing this Risk Alert to provide additional information concerning its initiative to assess cybersecurity preparedness in the securities industry.

Introducing Retirement Maps from Riskalyze.com

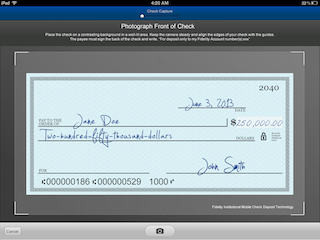

[And finally, rounding out this week’s update is a new feature from Riskalyze called Retirement Maps. Now many advisors like to illustrate a client’s probability of success in funding their retirement goals projected many years into the future, but the extensive data entry required and time consuming Monte Carlo calculations performed by most software programs can often be a deterrent of doing so.

So the new Retirement Maps aims to significantly streamline this process. Here’s Riskalyze CEO Aaron Klien with more details:

Best of all, Retirement Maps is being offered as a free upgrade to all existing Riskalyze customers, and for a limited time, new Riskalyze customers will also receive a free lifetime upgrade as well.] After thousands of hours of research and development, our Core Technology team invented a new way to deterministically calculate the 95% probability years into the future. There’s no waiting for a long, slow recalculation: you get an interactive way to build a map for the client’s retirement right in front of their very eyes.

Here are stories that didn’t make the cut this week:

The new LinkedIn Compliance Program from LinkedIn

Our Certified Compliance Partners provide expert monitoring, archiving, and management of communications for enterprises in regulated industries. They help your social interactions remain effective while ensuring compliance with corporate governance policies and major regulations.

Nashville wealth management startup raises $3 million from investors from Bizjournals.com

Wealth Access, a wealth management platform designed for financial advisers and high-net-worth clients, announced Wednesday that it had raised more than $3 million in a financing round that includes investments from a TNInvestco fund and a St. Louis financial technology accelerator.

XY Planning Network Adds Tech Partners from Financial Advisor magazine

XY Planning Network, the platform launched in early April by Michael Kitces and Alan Moore, announced Monday its list of “core” technology partners that will be available to current and new members of the platform, which is dedicated to helping young planners build a fee-only business targeting Gen X and Gen Y clients.

Orion Client Portal Goes Open Source from PRNewswire

Orion Advisor Services, LLC, the premier portfolio accounting service bureau, announces a complete redesign of the functionality and features of the client portal for its financial advisor clients. With this redesign, advisors have new capabilities to communicate more effectively with their clients, and give clients a complete snapshot of all their assets, whether managed by the advisor or not.

How the RIA business made a dent at the 2014 Finovate conference in San Jose from RIABiz.com

On the leading edge of financial services technology innovation, Personal Capital, Motif Investing, and more demo their latest features to change the way consumers engage with financial advisors.

Watch FPPad Bits and Bytes for May 2