Envestnet | Tamarac releases Tamarac University Online for comprehensive on-demand training

Envestnet | Tamarac builds an online university to help advisers master the company’s total office software

Training, or the lack thereof, can make or break the successful introduction of any new technology in a financial adviser’s business. (see Attend Redtail University and learn how to use Redtail CRM like a power user)

Fortunately, the time it takes to master many adviser technology tools has been decreasing consistently, since many applications have been thoughtfully updated with modern, intuitive interfaces and a uncluttered designs.

But when it comes to robust tools like portfolio rebalancing software, better design by itself just isn’t enough to make technology easier to use.

One example of this comes from the Advisor Xi suite of tools from Envestnet | Tamarac.

Better Adoption Through Training

Let’s walk through an example. Open up the Advisor Xi Rebalancer, and you don’t exactly know where to begin.

Tamarac University Online includes hours of video tutorials to guide users through various features

If you plan on rebalancing client accounts, your household positions first need to be up to date. That requires an update from your portfolio management software. Time to get some training.

Then when client account positions are current, you next need to compare current allocations with each client’s target portfolio. Time to create and define model portfolios. That requires training.

Next, when you identify what trades to execute to rebalance accounts, you need to know how to generate a trade file and submit it to the appropriate custodian. Training is required here, too.

The lists of processes goes on, and without proper training, acclimating to Advisor Xi (and to be fair, other similarly complex tools, too) can take much longer than originally anticipated.

Training On Demand

Envestent | Tamarac knows this all to well, and for years has been hosting live training events called Tamarac University.

Advisers new to Envestnet | Tamarac, as well as those looking to sharpen their mastery of the Advisor Xi suite, are welcome to attend the company’s two-day classroom style curriculum for a nominal fee.

But for advisers and back office employees unable to travel to the company’s live events in Seattle and Chicago, Tamarac University was not an accessible option for training.

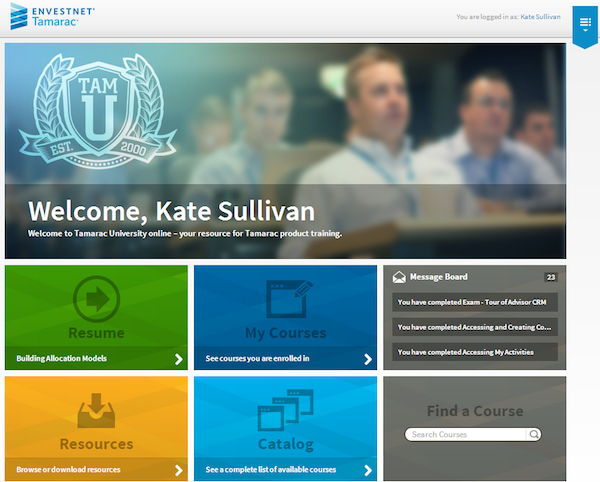

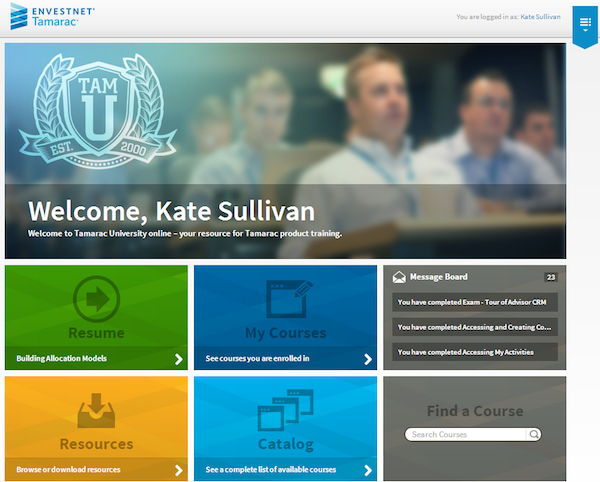

Now the company is providing access to comprehensive, on-demand training through a new massive online training course called Tamarac University Online.

Tamarac University Online

All clients can now access Tamarac University Online through the Support & Training Center. Once in the Support & Training Center, a Tamarac University tab launches clients into Tamarac University Online.

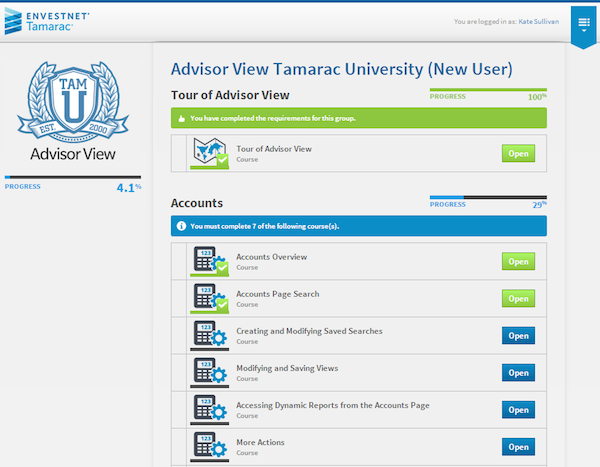

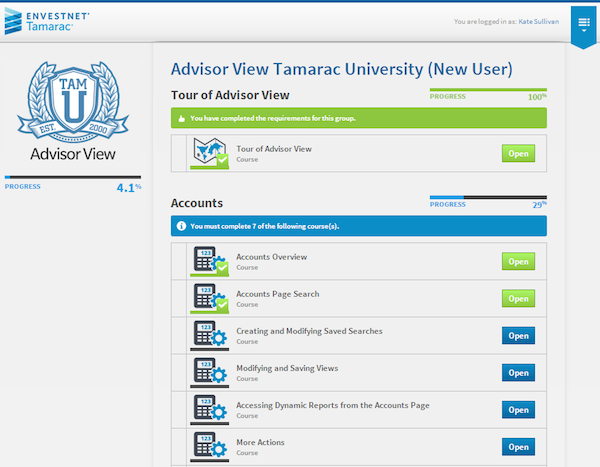

Tamarac University Online features modules for all three of the products in the Advisor Xi suite: Advisor CRM, Advisor Rebalancing, and Advisor View.

Inside each module are dozens of courses designed to cover the primary functionality of each product.

An example of the curriculum found in each of the Tamarac University Online modules.

As they navigate through the online courses, users are challenged with “knowledge check” activities to validate their lesson retention, followed by a final exam at the end of each course.

At any time, users with administrator privileges can monitor the progress of employees and advisors as they complete their training. In addition, users can complete evaluations at the conclusion of each course to provide feedback to Envestnet | Tamarac on the quality and organization of the curriculum.

Training Anywhere

Envestent | Tamarac invested in high quality learning management software to deploy Tamarac University Online, so the interface and user experience are overall very attractive.

The software is also HTML5 compatible, meaning Tamarac University Online can be accessed from any mobile device using the mobile web browser, so training need not be limited to one’s office computer.

Pricing

Tamarac University Online is available to all users at no additional cost. What else is there to say?

Users gain access to comprehensive training materials which cover much of the curriculum offered in the live events without requiring the commitment of time and travel.

Nevertheless, connecting with other Envestnet | Tamarac users face to face is valuable in its own right, so the company will continue to host Tamarac University in Seattle and Chicago in the future.

If you’re a Tamarac Advisor Xi user and haven’t yet enrolled, contact customer service to get enrolled, or if you’re considering Advisor Xi for your office, ask for a brief introduction to the available training resources so you know how well you will be prepared to make a transition.