Details of Institutional Intelligent Portfolios™ unveiled as Schwab arms its advisers with a robo solution

In company webcast and press release today, Schwab Advisor Services provided details of its Institutional Intelligent Portfolios™ solution that the company describes as an “automated investment management solution for independent registered investment advisors (RIAs).”

Earlier I had the chance to speak with Schwab Intelligent Portfolios executive vice president Naureen Hassan and Schwab Advisor Services technology and strategy senior vice president, Neesha Hathi to clarify several details about what financial advisers can expect from the new service.

Here are my important takeaways with a focus on the technology impact for your business.

Adviser Branding, but Schwab Domain

Institutional Intelligent Portfolios™ will be made available in Q2 2015 and it will allow advisers to use their own branding, which includes their firm name, logo, and contact information inside the end-client dashboard.

However, Institutional Intelligent Portfolios will be hosted on the Schwab web domain, so advisers cannot use their own custom website domain. Advisers must provide a link to Institutional Intelligent Portfolios somewhere on their website to direct end investors to the adviser-branded version of the solution.

Proprietary Paperless Process

Once logged in to the dashboard, investors go through an experience very similar to that of the retail Schwab Intelligent Portfolios solution (but one that uses the adviser’s branding and the adviser’s custom portfolios).

Investors answer the same questions about their goals and level of risk tolerance found in Schwab Intelligent Portfolios, and upon completion, investors are matched to a portfolio designed by the adviser that best fits the investor’s profile. This paperless process is proprietary to Schwab and does not support third party form-filling or electronic signature providers that are made available by other institutional custodians.

Investors use the paperless application process to open and fund their accounts and also receive their disclosure documents when they engage in the service.

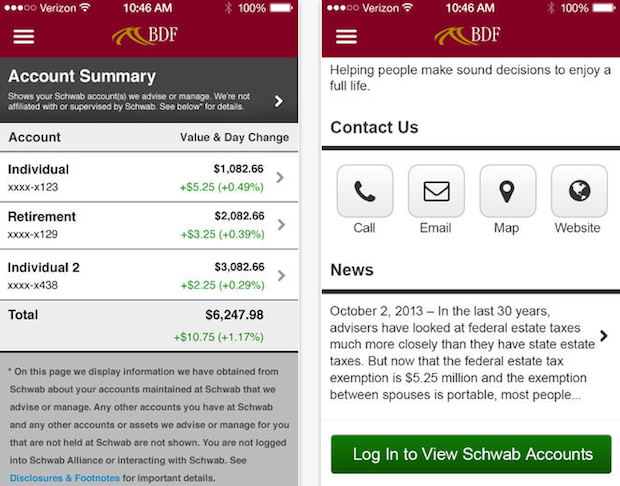

Mobile Minus Android

Schwab Intelligent Portfolio will be available as a native app for iOS devices, and a responsive website will offer an interface that is suitable for devices of all sizes.

According to Hassan, an Android app is in development but did not provide details on a future release date.

Account Management

Institutional Intelligent Portfolios allows advisors to create custom allocations from over 200 ETFs in the platform. Automated rebalancing and the opportunity for tax-loss harvesting is available for investor accounts greater than $50,000, and advisers can disable the loss harvesting algorithm if they so choose.

Loss harvesting applies only to the assets held within Institutional Intelligent Portfolios, so advisers must pay attention to transactions that trigger wash sales if substantially identical securities are held in outside accounts.

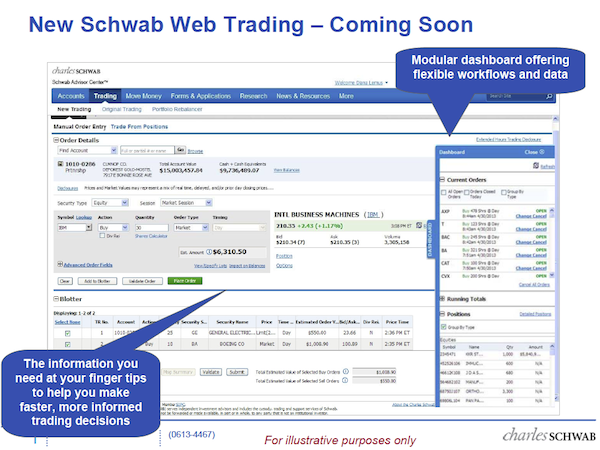

Note that advisers can view investor accounts using Schwab Advisor Center just as they do for the institutional accounts they manage on behalf of clients today. That means that data downloads are supported for assets held in Institutional Intelligent Portfolios. Since the data feeds are available just like any master account, Institutional Intelligent Portfolios holding data can be downloaded into other portfolio management software solutions available from third party vendors.

Finally, for account registrations, Institutional Intelligent Portfolios supports standard taxable brokerage accounts, joint accounts, Traditional and Roth IRA accounts, and living trusts.

Fees and Cash Minimums

With the technology attributes addressed, here are details of the fees of Institutional Intelligent Portfolios.

From the press release, Institutional Intelligent Portfolios has “a two-tiered pricing structure based on total assets custodied with Schwab outside the Institutional Intelligent Portfolios program.”

For advisers with less than $100 million in assets under management (AUM) with Schwab, investors will be charged a 10 basis point platform fee.

But for advisers with more than $100 million in AUM with Schwab, no platform fee is charged.

Schwab Intelligent Portfolios has been questioned for its up to 30% allocations to cash, but on the Institutional Intelligent Portfolios platform, portfolios must maintain a minimum of four percent in cash. The top end of the cash allocation is determined by the custom portfolios designed and configured by each adviser.