Remove your stolen videos from YouTube and enforce your copyright

Content thieves are stealing popular advisor videos to draw visitors to their questionable channels. Find out how to stop them.

Online video is still a blue ocean in the realm of financial advisor marketing, but content thieves are already stealing popular advisor videos to promote their own channels.

FPPad subscribers know that I started creating video content back in February 2012, beginning with interviews of industry technology leaders from the TD Ameritrade Institutional 2012 National Conference and T3 2012 Conference.

And this summer, I launched FPPad Bits and Bytes, the industry’s only video broadcast devoted to covering the best technology news of the past week.

Thieves Like Popular Content, Too

I put a lot of energy and effort into creating videos for you with the objective of providing insight and commentary on a variety of technology solutions you can use in your business. With currently over 25,000 views on the FPPad YouTube channel, you are validating that this type of content delivery is useful.

So when I discovered content thieves were stealing my popular videos, I was irate.

You see, like most Google services, YouTube allows content publishers to participate in online advertising via Google AdWords for video. So if content on your YouTube channel receives a lot of views and you opt in to the AdWords program, you stand to earn a small amount of income in the form of advertising revenue.

But the downside to this is content thieves know this all too well, so they want to maximize their own channel’s ad revenue without publishing any original content of their own.

So they steal it.

How to Find Your Stolen Videos

Metrics are an important part of any content distribution, so I regularly monitor YouTube video analytics to see how well my videos are being received.

Part of that process includes searching for my channel and related videos on YouTube using specific keywords to see how they rank among similar content on YouTube. I’ll use common search phrases like FPPad, financial planning technology, financial advisor apps, and so on to determine what I can do to make my videos show up near the top of YouTube’s search results.

But imagine my surprise when not long ago, a search displayed one of my videos that was NOT part of my YouTube channel.

By searching YouTube for FPPad, I found several episodes of FPPad Bits and Bytes were posted to a channel called “financial websites”. View their YouTube channel here: https://www.youtube.com/channel/UC-AMsCUZ4Mqib9B9YnrEPLQ?feature=watch

Note: I did not want to post the “financial websites” channel at all and send any traffic to it, but if you have uploaded video online, it’s worth searching through the 400+ videos to see if any of them are yours.

Stolen Video Search Technique

Fortunately, “financial websites” is a lazy thief. They simply download original videos from another source, re-upload them to their channel, and copy and paste the video title and description.

This laziness on their part makes it easier for you to find your stolen videos.

So search for the exact titles of videos you post online, including any keywords that you often use, such as your company name or episode series title.

If the thief simply copies and pastes your content, then you have a high likelihood your stolen video will appear using a very specific search query.

How to Remove Your Stolen Video from YouTube

If you do find one (or more) of your videos uploaded to another channel, here is what you need to do to get the video removed from YouTube.

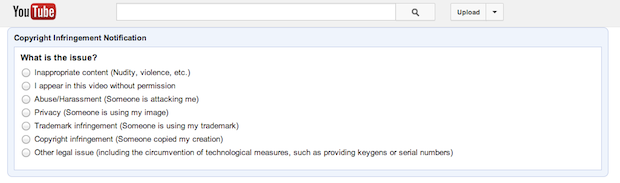

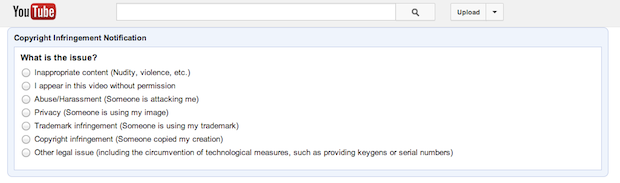

YouTube provides an online Copyright Infringement Notification form that you can complete in just a few minutes.

Complete the YouTube online Copyright Infringement Notification form to have your stolen video removed

You’ll need the URL of your original video (the work allegedly infringed) as well as the URL of the allegedly infringing video to be removed.

You will also need to provide your legal name and address and attest that you are the content owner along with other standard claims required of a Digital Millennium Copyright Act (DMCA) copyright violation notice.

What’s nice is you can use the completed form for a single video violation, or add multiple videos to the same form, saving time if multiple videos you created have been stolen.

Copyright Takedown Turnaround

In my case, two of my videos had been uploaded to the “financial websites” channel, and within about 24 hours of submitting my notice to YouTube, I received confirmation that both infringing videos had been removed.

So again, if you publish video online, on YouTube or elsewhere, here’s what you need to do to protect your content.

Search YouTube for the exact title of your most popular videos. Also search using keywords that appear in many of your video descriptions.

When you find an allegedly infringing video, complete the online Copyright Infringement Notification form.

And if you find a different YouTube channel using your videos online, post the channel name in the comments below so others can search it for alleged violations of their copyrighted material.