Wow, it’s June already? I returned from presenting at FPA NorCal this week on top apps for financial advisers. If you want some of the inside scoop, check out the #FPANorCal hashtag or tweets from Michael Kitces while they’re still on his timeline (you’ll need to scroll down to see tweets from May 29).

Here are this week’s stories of interest:

How Can RIAs Improve Efficiency? from Financial-Planning.com

[Donna Mitchell covers a new report from Pershing Advisor Solutions with three ways advisers can be more efficient, but it doesn’t list any resources to use. So here’s a recap of Pershing’s insight with a resource thrown in: 1) Identify an ideal client profile (self explanatory), 2) Have a consistent business process (so you need a tool to define workflow), and 3) avoid overloading staff members (I wish I had a solution for that!)] Principals of RIA firms need to pay closer attention to workflow and operational issues at their firms, especially if they want to stay viable amid rising operational costs, Pershing Advisor Solutions said.

Advisers still shaky on social media policy from Reuters

[Guess what: you need a social media policy, even if your policy is ‘we don’t use social media.’ And what about Facebook ‘Like’ buttons? It appears that as long as a ‘Like’ stands on its own without any additional commentary, advisers aren’t violating regulatory rules prohibiting testimonials.] As the securities industry finally warms up to using social media sites such as Facebook and LinkedIn, regulators are discovering that brokerages and investment advisers are off to a rocky start.

Plantly launches “missing allocation tool” to the public from FPPad

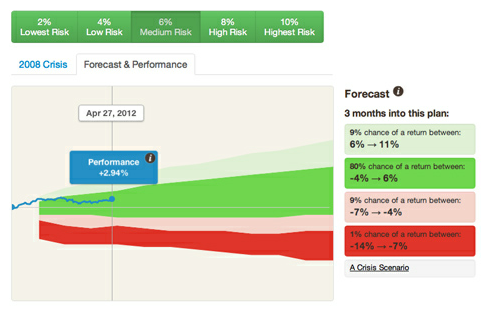

[It’s my blog so I get to link to my own posts once in a while. Most of you are familiar with Personal Capital, Betterment, SigFig, and Wealthfront in the race to deliver online financial advice to investors. Plantly is yet another startup aiming to equip DIY investors with simple plans based on MPT models. Oh, it’s free to use today.] Brooklyn-based startup launches free asset allocation planning tool to the public.