Intuit’s Financial Data API looming shut down will have a ripple effect across popular account aggregation providers

Intuit’s looming Financial Data API shut down will have a ripple effect across popular account aggregation providers

Quick Take:

- Intuit is discontinuing its Financial Data APIs widely used for financial institution account aggregation

- Account aggregation providers using Intuit feeds (e.g. Blueleaf, Quovo, Wealth Access, Plaid and more) may need to transition to an alternate account aggregation provider

- Intuit identified Finicity as a suitable account aggregation provider, but Finicity has issues around its business that raise concern for me

- For advisors, your clients will have to reauthorize any accounts aggregated using the Intuit APIs as various companies phase out their use of the Intuit data feed

On March 15, 2016, Intuit announced they have decided to discontinue the Financial Data APIs (formerly CAD). No new direct Financial Data API (CAD) developers will be allowed to move into production.

The API will be maintained only for current production developers until November 15, 2016 to enable time for migration.

In the wake of Intuit’s decision, Guide Financial became the first adviser fintech provider to announce they are shutting down their service later this year. See Guide Financial to shut down operations on October 11.

Intuit identified Finicity as a solution that will provide a “façade” API interface that translates Intuit-structured API calls into Finicity-structured API calls.

Financial Data API Backstory

The Financial Data APIs from Intuit allow developers to link to end-users’ banking accounts from within their application.

In September of 2012, Intuit announced that it was opening up the technology that powered Intuit products like Mint.com, Quicken, and QuickBooks to the developer community via a library of APIs that it called Customer Account Data (CAD).

Customer Account Data, which was rebranded Financial Data APIs, is composed of two separate products: the Transactions API and the Identification API Beta.

The Transactions API offered connections to roughly 20,000 US and Canadian financial institutions, enabling third-party developers to quickly and cost-effectively deploy aggregation functionality to a wide array of financial sources.

The Identification API Beta facilitated customer’s identity and banking account verification using banking credentials. Developers were able to configure ACH connections via the API instead of relying on microdeposits (a series of deposits under $1 that the customer verifies) and a process called “fatfingering.”

FinTech Floodgates

The general availability of the Intuit Financial Data APIs opened the floodgates of all sorts of new B2C fintech startups that featured the aggregation of users’ financial accounts. These startups included popular names such as LearnVest, SaveUp, Hello Digit, BillGuard, and more.

A similar increase has taken place among B2B account aggregation providers, with companies like Blueleaf, Wealth Access, Quovo, Plaid, and Right Capital all appearing with some type of advisor aggregation fintech solution over the last four years.

Prior to the new wave of account aggregation providers, advisor solutions were dominated by four key players:

Intuit Gave, Intuit Hath Taken Away

So now that Intuit is going to shut down access to its APIs, several fintech aggregators should find themselves scrambling for a suitable replacement before November.

Based on my research, many companies I mentioned earlier are going to have to fill the gap left by Intuit’s hole in the marketplace. They include:

Note: Prior to August 30, 2016, I had Right Capital in the list above. After connecting the Right Capital co-founder Shuang Chen, I learned the company had considered Intuit’s API for aggregation at one time, but ultimately decided to engage Yodlee for account aggregation. Therefore, Right Capital will not be affected by the Intuit API shutdown.

In its press release, Intuit identified Finicity as an alternate provider of aggregation services.

We have identified a new aggregation partner, Finicity, for whom this service is a core part of their business. Finicity can offer long-term benefits and service for our aggregation customers. To minimize developers’ engineering work to switch APIs, Finicity will provide a façade API interface that translates Intuit-structured API calls into Finicity-structured API calls.

The “façade API interface” means that developers with existing code that calls on Intuit APIs will not need to change their codebase. Instead, Finicity will publish an API interface that is 100% compatible with existing calls to the legacy Intuit APIs and return data to the developer’s application as if Intuit’s APIs never went away.

Who is Finicity?

For me, Finicity is a newer name in aggregation that came to my attention last year while monitoring Quora for details on Yodlee despite founding the business in September 2000.

While the Finicity compatibility endorsed by Intuit sounds good for existing developers, there are certainly other issues to consider before building a business on top of Finicity services, and that absolutely should factor into the due diligence process of advisors.

Finicity has a relatively unremarkable profile in CrunchBase, but a few more details about adoption and marketshare come from Finicity co-founder Nicholas Thomas from this Quora question:

2015 has been a good year for Finicity. We’ve signed hundreds of Fintech and Financial Institutions to build their solutions on our API, have quietly launched over a dozen partners, and are launching dozens more in 2016. Our partners tell us that our broad native data source coverage and our fanatical agg support teams are the primary reasons why they love us.

-Nicholas Thomas

So with relatively little marketing (e.g. as I published this, their most recent tweet was on October 27, 2015), Finicity managed to sign up “hundreds” of customers, launched “over a dozen” partners, with more on tap in 2016.

Is account aggregation Finicity’s only play in the industry? No.

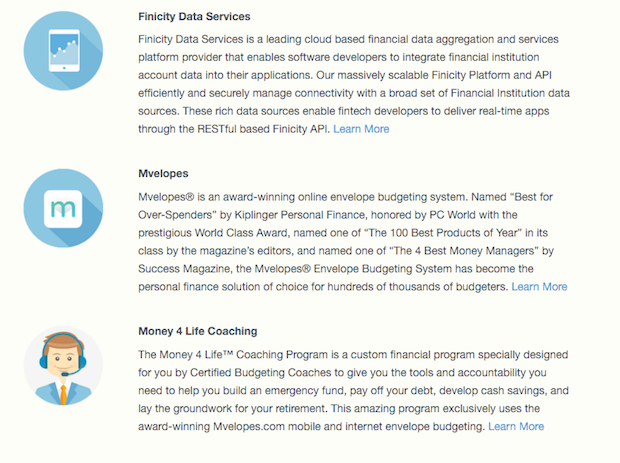

To see what other lines of business Finicity offers in addition to their aggregation services, their website lists two other divisions: Mvelopes and Money 4 Life Coaching

Mvelopes from Finicity

Mvelopes is a software application for personal budgeting and has extremely high ratings for its apps in the app stores. Surprisingly high, actually (more on this later).

Mvelopes allows users to create virtual envelopes for different spending categories and allocate money to them accordingly. The idea is that throughout the month, users refer to the amount of money left over in each envelope after paying bills in order to preventing overspending. Transactions are aggregated from connected accounts, and transactions are automatically deducted from applicable virtual envelopes of available cash.

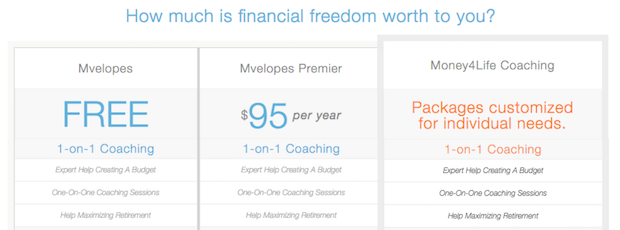

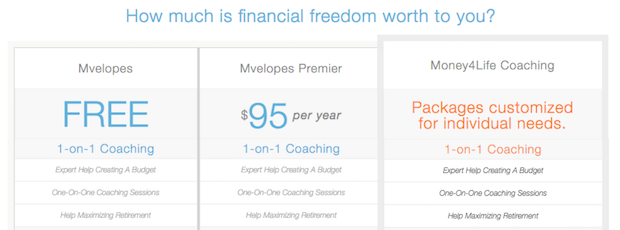

The service is free to use with a limit of four aggregated cash flow and credit accounts (here’s the Finicity aggregation connection). To access unlimited accounts, users subscribe to the Mvelopes Premier plan for $95/year.

Money 4 Life™ Coaching

Where things get more controversial for me is Finicity’s division called Money 4 Life™ Coaching. The Mvelopes pricing page makes the first mention of coaching services and describes how customers can benefit from one-on-one coaching customized for individual needs.

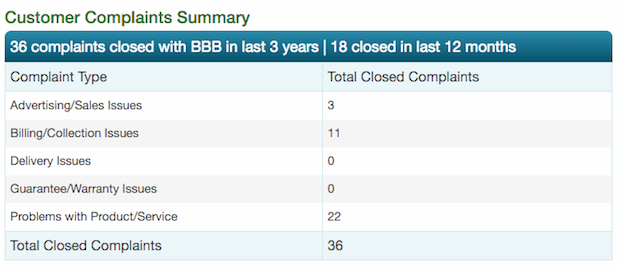

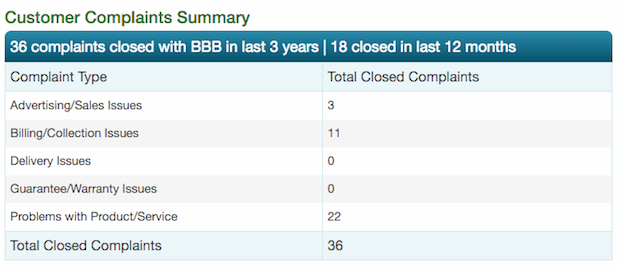

So I looked into this coaching services with a quick Google search and came across quite a few consumer complaints (36 to be exact) about the services on the Better Business Bureau website.

Most of the complaints seem to be centered around the Money4Life coaching including allegations of no contact by coaches for months at a time and allegations of cancellation difficulties.

Most complaints listed on the BBB site appear to reach a satisfactory conclusion once customers initiate the dispute process (which results in an overall BBB rating for Finicity of A+) , but it is surprising that many customers feel that they need to involve BBB in the first place in order to reach a resolution.

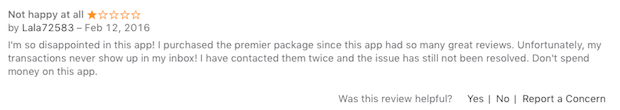

Also, the Mvelopes mobile app ratings are overwhelmingly positive, but many of the five-star reviews have no details in the description or come from users with no other app reviews other than Mvelopes. It’s eyebrow raising.

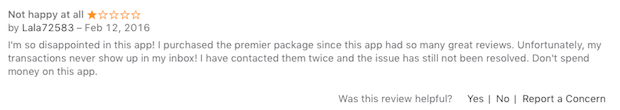

Critical Mvelopes app reviews such as the one below from iTunes are enlightening:

I contacted Finicity for comments and have not yet heard back from the company, so I will update this post accordingly.

What’s Next?

So what’s next? Given Finicity’s connection to awkward customer experiences under the Money4Life coaching program, how likely are the younger aggregation providers to migrate their API calls to the Finicity API? Or will there be a trend to simply abandon the aggregation of financial institutions currently covered by Intuit?

No matter what, as the aggregation vendors make their decisions behind the scenes, advisors’ clients will need to reauthenticate their usernames and passwords once a migration to a new aggregation service is implemented.

For some firms that have a handful of aggregation accounts, this may be a non event, but for larger firms with thousands of aggregated accounts, the issue could take weeks or months to resolve as all clients work through their accounts to reauthenticate their login credentials.