The lede!

- Betterment adjusts its default fee structure to 25 basis points for accounts of all sizes for what is now called Betterment Digital (the 35bps, 25bps, and 15bps tiers are gone)

- Betterment customers who formerly qualified for the 15 basis point tier will see their fees increase 67% to 25 basis points. Some customers are not pleased

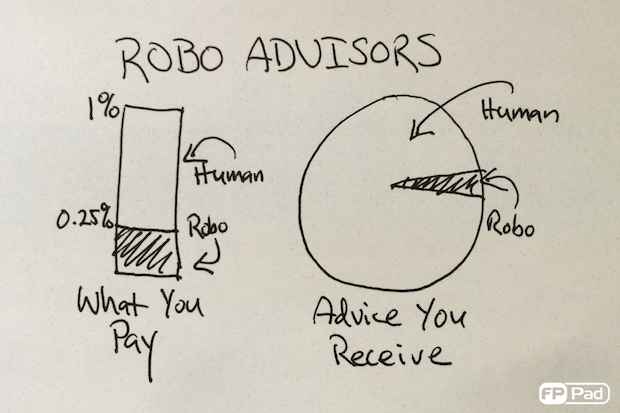

- New Plus and Premium plans are offered that introduce hybrid advice engagements from human advisers for an additional fee

- Betterment Plus includes an annual planning call with the in-house adviser team and support via email. Betterment Plus pricing is 40 basis points and requires a $100,000 account minimum

- Betterment Premium include unlimited contact with the in-house adviser team via phone and email. Betterment Premium pricing is 50 basis points and requires a $250,000 account minimum

- All Betterment plan fees are capped, charged only on the first $2 million of a customer’s balance.

- Betterment is introducing the Betterment Advisor Network™, launching with roughly ten advisers who have complete the Betterment vetting process, all of whom must hold the CFP® certification

- There is no fee to be included in the adviser referral network

- Betterment receives no referral fees for directing customers to any specific adviser in the referral network

- Customers who work with an adviser in the Betterment referral network pay a fee of 25 basis points on their assets in their Betterment account. The adviser can set an additional fee on top of Betterment’s fee for services provided

Betterment introduces hybrid advice plans with access to in-house CFP® professionals

Betterment announced today that the company will introduce hybrid advice offering with access to an in-house team of financial advisers.

For the full details from Betterment, see the post below from the Betterment website:

The Best of Both Worlds: Smart Technology + Financial Experts

Fee Fallout

One unfortunate consequence of the new 25 basis point pricing structure is the elimination of the 15 basis point tier that formerly applied to accounts over $100,000.

Reaction on Twitter was swift, as these customers will see their fees increase by roughly 67%.

@Betterment that's an awfully long email i just got just to say you're raising your fees from 0.15% to 0.25% 🙁

— Ian Dees (@iandees) January 31, 2017

@Betterment This is kick in the face to customers that were saving aggressively to reach the lowest cost .15% management fee.

— Robert Pedigo (@rjpedigo) January 31, 2017

Fee Parity Between Retail and Advisor Platforms

Despite the frustration of customers who formerly qualified for the 15 basis point tier, Betterment Digital’s pricing establishes parity with the pricing offered in the Betterment for Advisors (formerly Betterment Institutional) service.

Since the Betterment for Advisors introduction, I had been critical of the conflict the different pricing tiers presented for advisors who chose to implement Betterment for Advisors for their clients.

I often questioned how an adviser could meet his or her fiduciary obligation to clients with over $100,000 in assets, as that client would pay fees of 15 basis points using a “retail” Betterment account, where a minimum fee of 25 basis points would be charged on a Betterment for Advisors account, for asset management services that I felt were essentially equivalent.

Today, that fee disparity, and the fiduciary quandary, is eliminated, but at the expense of raising fees for customers who qualified for the former 15 basis point tier.

Betterment undercuts Personal Capital

One other observation is Betterment Premium now enters the competitive hybrid advice market, a space dominated by Vanguard Personal Advisor Services, that is also occupied by Personal Capital and the Schwab Intelligent Advisory offering scheduled to debut sometime in the first half of 2017.

Betterment Premium is more expensive than the 30 basis point fee Vanguard Personal Advisor Services and the 28 basis point fee from the upcoming Schwab Intelligent Advisory, but at 50 basis points, the service undercuts Personal Capital’s current 89 basis point pricing.

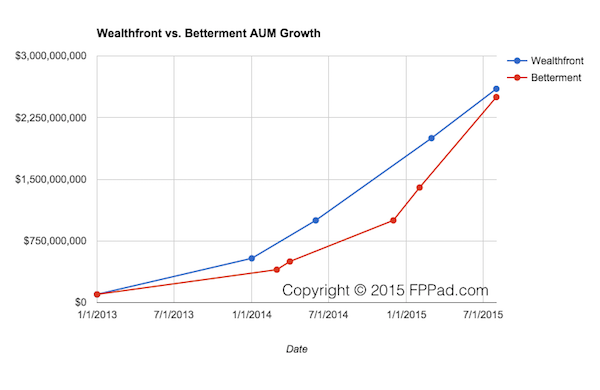

In the race for robo adviser supremacy, neither Wealthfront nor Betterment wants to be runner-up.

In the race for robo adviser supremacy, neither Wealthfront nor Betterment wants to be runner-up.