tl;dr: Algorithms are incapable of giving financial advice, so the oxymoron “robo advisor” is a perfect moniker. Know what you’re getting (and not getting) from automated investment services.

“I am tired of the whole robo thing,” says Motif Investing CEO Hardeep Walia.

Personal Capital CEO Bill Harris bemoans, “We are not a robo advisor.”

Wealthfront CEO Adam Nash retorts, “New tech doesn’t always fit neatly into a bucket.”

Cry Me a Robo River

To the automated investment services, I say,

“Boo hoo.”

NOW these services are beginning to experience how it feels when others, right or wrong, control the conversation about their business.

Most journalists, reporters, TV anchors, correspondents, bloggers and more don’t really know what makes any of the automated investment services different from one another, so most simply package them up into one catch-all term “robo advisor.”

Let’s face it: “robo-advisor” makes for great click bait. If it didn’t work (and generate clicks and eyeballs), editors and producers would stop using it. (You clicked to land here, didn’t you?)

But please, asking everyone to stop using “robo advisor” because it misrepresents what you do or somehow marginalizes your service in some way?

I submit to you Exhibits A and B.

“You don’t need that guy,” gloats Wealthfront’s ad.

Sure, because most financial professionals out there are just glorified psychics, spiritualists, or stock market prognosticators whose only tool for financial advice is a crystal ball!

Please.

The financial services industry has seen this marginalization long before automated investment services arrived.

Living In Glass Houses

The fiduciary financial professionals should be just as upset about this gross characterization of fortune tellers as the automated investment service providers are about the term “robo advisor.” (people who live in glass houses…)

“Stop comparing us to fortune tellers!”

“We are not personal psychic advisors!”

Perhaps Wealthfront paints with too broad a brush. Ok, so here’s Exhibit C:

Wealthfront: Don’t Pay For Expensive Financial Advisors

See? “Don’t pay for expensive financial advisors.”

Why not?

Because Wealthfront is the end-all-be-all service that investors need? Because Wealthfront does the exact same thing all fiduciary financial advisors do? Because all your financial needs are met by Wealthfront’s software?

Ask a Question 100 Times…

Go ahead, go to any automated investment service website right now. Wealthfront. Betterment. Future Advisor. Even the anti-“robo-advisor” Personal Capital. (*read my note below)

Fill out their questionnaire. Complete a free “Investment Checkup.”

What is the answer you get?

The answer from ANY of these services is ALWAYS to invest.

ALWAYS.

There is no Plan B, no backup option, no alternate strategy.

There’s no, “You really should first pay off your high interest credit card balances.”

No, “You should save up an emergency fund where you can access the money quickly.”

No, “You should create a will and advance medical directives first in case something were to happen to you.”

But ask automated investment services a question 100 times, “What should I do with my money?” and the answer is always going to be the same:

Invest in a diversified portfolio of low cost ETFs.

It’s the only answer these services have. There’s nothing else.

It’s not financial advice. It’s not wealth advice.

It’s barely investment advice.

It’s an investment recommendation. The output of a calculator.

Sophisticated or not, automated investment services are ALWAYS going to recommend investing your money.

There simply is no other result to offer. The algorithms today are incapable of suggesting anything but investing.

So Why Robo Advisor?

So why robo advisor as a moniker?

Because it is a oxymoron, a name that contradicts itself.

Algorithms, software programs, aka “robots” are incapable of making judgment calls and evaluating emotions or feelings in the calculation process.

Robots can’t give advice.

Robots can only decide based on ones and zeroes. True or false.

Sure, an algorithm’s answer can be associated with a level confidence (recall IBM’s Watson playing Jeopardy), but each discrete answer is associated with a level of confidence based off of a set of discrete factors evaluated in the calculation process.

An algorithm’s output is a result. Functions return arguments.

But don’t call that advice.

Know What You’re Getting

As with most decision-making processes, there’s often a big difference in what you can do and what you should do.

What is important to you? How does a decision make you feel? How do you prioritize your goals?

Can your entire life, your goals, your dreams, your aspirations be captured in a four question survey? A ten question survey? Even a hundred question survey?

For automated investment services to survey the market and say “Hey, we can improve investing outcomes by building a software program that does everything on the cheap!”

The questionnaire is only part of the advice process, it is not the start and finish.

And then there’s the talk of disruption, mainly coming from the media (I don’t recall any of the automated investment services specifically saying they intend “to disrupt” the financial services industry).

What industry are automated investment services attempting to disrupt, anyway?

Vanguard, the mutual fund giant, has been offering diversified, low-cost investment products and services quite successfully since the 1970s.

Just remember that the next time you consider the services of an automated investment service, know what you are getting.

Do your homework.

You are getting the results of a calculator.

The calculator is programmed to give an answer.

Not advice.

Not from a robot.

Don’t assume that the answer you get is the best answer for your situation.

Who you are as a person cannot be summed up in an online questionnaire.

*Note: Personal Capital toes the line on the robo advisor definition. Users complete the Investment Checkup and receive a target asset allocation illustration based on answers to the short questionnaire. However, specific mutual funds and ETFs are not recommended, so it’s not explicit. Users do get a basic automated investment allocation recommendation with no human intervention, but it’s up to the user to connect each recommended asset to a specific mutual fund or ETF to purchase. Users who want specific fund and ETF recommendations must engage Personal Capital for traditional investment advice rendered by human advisers and pay Personal Capital’s standard fees. This formal engagement is not robo advice.

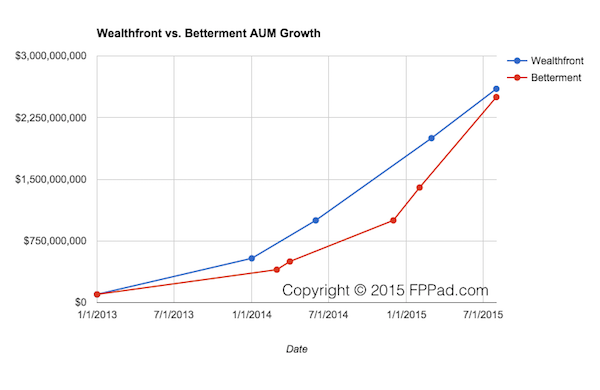

In the race for robo adviser supremacy, neither Wealthfront nor Betterment wants to be runner-up.

In the race for robo adviser supremacy, neither Wealthfront nor Betterment wants to be runner-up.