Here are this week’s stories of interest:

New Apps for the Mobile Financial Adviser from The Wall Street Journal

[Clearly, mobile devices and their software apps are changing the way you do business. Expect even more functionality and enhanced security, such as facial recognition or biometrics, for mobile devices in the coming years.] Smart gadgets packed with apps are changing the way financial advisers do business and relate to their clients. As more advisers snap up mobile devices like iPads, the investment firms they work with are offering up apps that let them do their jobs from a small screen.

Money management, Silicon Valley-style from Forbes

[Forbes managed to extract info from start-up Addepar that both RIABiz and I failed to get. Now we know Addepar charges 5 basis points on AUM, generates about $25 million in revenue, has 75 “lean” employees, and a sales force with connections to the ultra high net worth segment of the wealth management market.] Having made a small fortune in his twenties, Joe Lonsdale has set his sights on a new challenge: designing software for the ultrawealthy.

Personal Capital Unveils its Professionally Managed 401(k) from Finovate.com

[So who out there has 401(k) fee evaluator tools? Brightscope and FutureAdvisor do, and they’ve been mentioned here before. Now start-up RIA Personal Capital has one, too. Add this to their free mobile app, free peer-to-peer payment support, and free stock option analyzer, and you’ve got a robust offering of pipeline-filling marketing tools. Oh, and they now are selling “America’s BEST 401k” plan at http://www.personalcapital401k.com/ with management fees around 50 basis points.] Personal Capital will be demoing its free 401(k) fee calculator, which enables users to determine how much their 401(k) costs and what long-term fees they can expect to pay over time. The calculator has the potential to save investors hundreds of thousands of dollars over a lifetime.

Advent Adds Alternative Investments Solution to Black Diamond Platform from MarketWatch.com

[Alternative investments are gaining adoption among financial advisers. The challenge with them, though, is getting updated data populated in a portfolio management system like PortfolioCenter, AssetBook, and in this case, Advent. From the press release, it sounds like advisers have a way to perform bulk updates to alternative assets in Advent’s Black Diamond platform. If there were 30 hours in a day, I’d have specifics for you on how that actually takes place.] Advent Software, Inc., a leading provider of software and services for the global investment management industry, today announced the launch of an alternative investments solution within the Black Diamond platform. The new functionality enables advisors and wealth managers to manage and report the details of their alternative investment holdings down to the transaction level allowing them to provide a more complete financial picture to their clients.

MarketCounsel Sells MailBanc Messaging Unit to Global Relay from AdvisorOne

[MarketCounsel’s MailBanc email archiving service was one I covered last year in a review of archiving providers for Morningstar (see Avoid E-mail Audit Headaches). Thursday MarketCounsel said it sold MailBanc to archive provider Global Relay, who by no coincidence, was also featured in the same Morningstar column. When MailBanc was launched, advisers had few choices for email archiving. Today, there are many more options. As founder Brian Hamburger said, “The industry has now matured to a point where we can step aside and continue our focus on RIAs.”] “We have sold our MailBanc messaging compliance service to Global Relay,” Hamburger said, offering no details of the deal.

Junxure Achieves Company Milestone, Surpasses 10,000 Active Users from eReleases.com

[The number-two CRM (according to most financial advisor surveys, and excluding Microsoft Outlook!), now has over 10,000 users on its platform. This is a good milestone for a niche product, but the company faces an uphill battle to close the gap with leading CRM provider Redtail Technologies, which at last report had over 43,000 users.] Junxure, an industry-leading CRM practice improvement firm that integrates technology, consulting, and training, today announced that it surpassed 10,000 active users on its Junxure CRM as of July 2012.

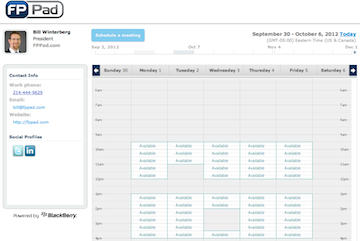

Last month Tungle announced they’re shutting down their popular public calendar and scheduling service (see: Tungle, my go-to calendar service, is shutting down. Here are public calendar alternatives financial advisers should consider).

Last month Tungle announced they’re shutting down their popular public calendar and scheduling service (see: Tungle, my go-to calendar service, is shutting down. Here are public calendar alternatives financial advisers should consider).

LearnVest

LearnVest