I’ve been back in Dallas for a week, but I still have yet to review and edit my notes from Schwab IMPACT 2011. Soon I hope to have two or three new updates on my feedback from conference breakout sessions, but consulting, new content development, and family obligations take precedence. Still, I’ve kept my pulse on the wires this week for the best in technology stories for financial advisers.

First, if you have a website, but are wondering what you can do to take it to the next level and convert visitors to clients, read this month’s column on Morningstar Advisor, How Marketing Automation Can Accelerate Client Growth.

First, if you have a website, but are wondering what you can do to take it to the next level and convert visitors to clients, read this month’s column on Morningstar Advisor, How Marketing Automation Can Accelerate Client Growth.

All the major media outlets were on site at Schwab IMPACT 2011, so there were a number of stories released this week regarding related announcements. Most of them were good, but in this case, video content did a better job of addressing what the custodian is doing with its technology platform for advisers than print.

Here are two video updates from Schwab IMPACT worth viewing, one from InvestmentNews’s Davis Janowski interviewing Neesha Hathi and a second from James J. Green’s AdvisorOne, also interviewing Neesha Hathi.

Advisor Tested: Arkovi expands and archives a firm’s online footprint from RIABiz.com

[As an adviser in a regulated industry, you can’t tweet, post to Facebook, or interact on LinkedIn if it’s related to your business unless you archive and supervise your records. One tool that facilitates your compliance obligations is Arkovi, and Judy Messina gives a good rundown in this RIABiz Advisor Tested story.] As registered investment advisors flock to Twitter, Facebook and other social-media sites to establish themselves as thought leaders and connect with customers and other investment professionals, storing and keeping track of tweets, posts and other content for compliance purposes can seem like an exercise in herding cats.

And in related news, I think you might care a little bit about what might happen with the future of regulatory examinations for investment advisers.

Let RIAs Foot Their Own Examination Bill, Report Says from FA-Mag.com

[In a report commissioned by TD Ameritrade Institutional, Georgetown University finance professor James J. Angel proposed that RIAs should pay for their own periodic compliance examinations conducted by an outside third party. There’s merit to this idea, as RIAs who take custody of client assets today must subject themselves to (and pay for) a surprise audit by an independent public accountant that is registered with the Public Company Accounting Oversight Board (PCAOB).] Instead of the Securities And Exchange Commission (SEC) or the Financial Industry Regulatory Authority (Finra) examining RIA firms, the firms themselves should foot the bill for their own periodic compliance examination by using an outside body.

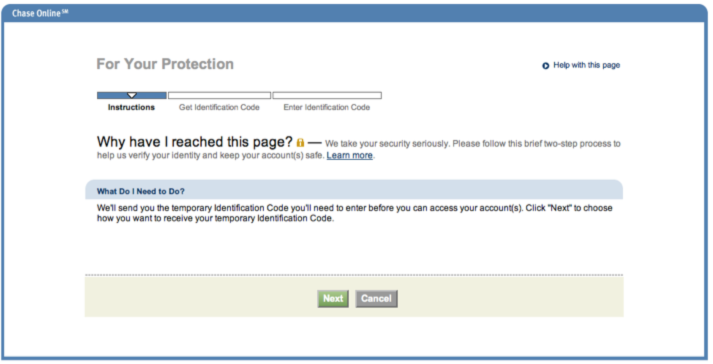

After participating virtually (e.g. online) in what was likely the busiest shopping weekend of the year last week, I logged in to reconcile one of my credit card accounts. Lo and behold, they added a new security feature to authenticate my account when I used a second computer to log in.

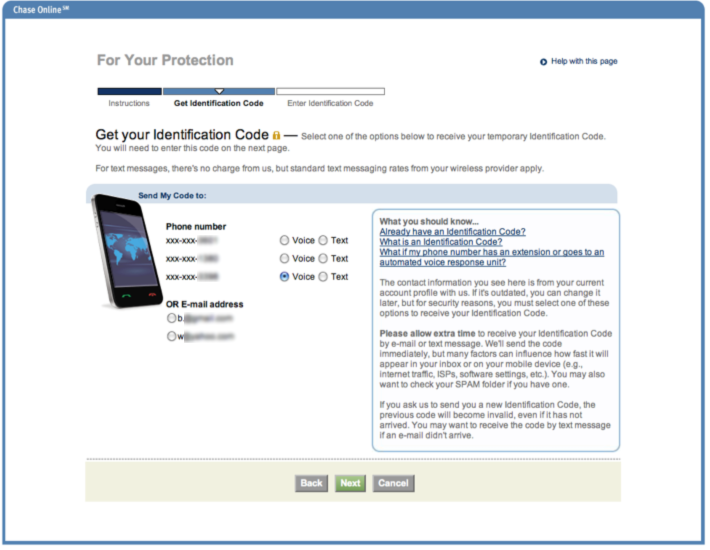

After participating virtually (e.g. online) in what was likely the busiest shopping weekend of the year last week, I logged in to reconcile one of my credit card accounts. Lo and behold, they added a new security feature to authenticate my account when I used a second computer to log in. After clicking Next, I was given the option of receiving my code using several contact methods associated with my account profile. Options included voice or text messages to one of my phone numbers or receiving a code via an email account previously registered to my account.

After clicking Next, I was given the option of receiving my code using several contact methods associated with my account profile. Options included voice or text messages to one of my phone numbers or receiving a code via an email account previously registered to my account. Just as in my

Just as in my

Frequent visitors to FPPad know I speak at a number of conferences and events. This year, two of my latest presentations have received excellent reviews and are in high demand: The iPad® for Financial Services and Transformative Technology You Can Implement Today.

Frequent visitors to FPPad know I speak at a number of conferences and events. This year, two of my latest presentations have received excellent reviews and are in high demand: The iPad® for Financial Services and Transformative Technology You Can Implement Today.

Last week, AdvisorOne/Summit Business Media and ActiFi announced that they are launching a research study on advisor practice management.

Last week, AdvisorOne/Summit Business Media and ActiFi announced that they are launching a research study on advisor practice management.