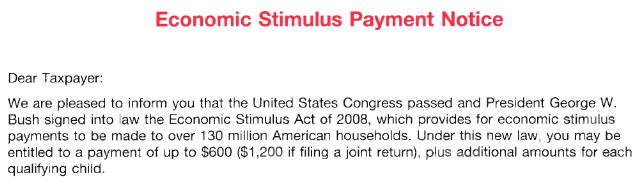

After several notices this year, I finally received my first phishing attempt by folks masquerading as the IRS. Here is their note below:

After several notices this year, I finally received my first phishing attempt by folks masquerading as the IRS. Here is their note below:

After the last annual calculations of your fiscal activity we have determined that you are eligible to receive a tax refund of $2839,49. Please submit the tax refund request and allow us 3-9 days in order to process it.

A refund can be delayed for a variety of reasons.

For example submitting invalid records or applying after the deadline.To access your tax refund, please click here <link removed>

Best Regards,

Tax Refund Deparment

Internal Revenue Service

© Copyright 2008, Internal Revenue Service U.S.A. All rights reserved.

TAX REFUND ID: IRS822513

Oh man, March has been a terrible productivity month for me. I caught a bad cold the week of the 10th and missed most of the week at work. Then I left on the 14th for California for vacation with my wife. Fortunately my health improved as my vacation began, so it wasn’t a complete loss.

Oh man, March has been a terrible productivity month for me. I caught a bad cold the week of the 10th and missed most of the week at work. Then I left on the 14th for California for vacation with my wife. Fortunately my health improved as my vacation began, so it wasn’t a complete loss. Notices from the IRS regarding the Economic Stimulus Payments are now being mailed to taxpayers. In case you haven’t received yours, I uploaded a PDF copy of one.

Notices from the IRS regarding the Economic Stimulus Payments are now being mailed to taxpayers. In case you haven’t received yours, I uploaded a PDF copy of one.

A little more than a week ago

A little more than a week ago  I suppose my blog doesn’t have to revolve around financial planning 100% of the time. Still, financial planners buy plenty of airline tickets to attend national conferences, study groups, and retreats. A little more than one month ago, I started using a tool called

I suppose my blog doesn’t have to revolve around financial planning 100% of the time. Still, financial planners buy plenty of airline tickets to attend national conferences, study groups, and retreats. A little more than one month ago, I started using a tool called  Most people out there are well aware of Congress’ recent action to provide

Most people out there are well aware of Congress’ recent action to provide  Surprise, surprise: members of Generation X have little faith in financial firms and financial advisers, according to a study recently released by Charles Schwab. Titled Gen X Money Mindsets, I was not surprised at all by the results. Below is a short comment from this

Surprise, surprise: members of Generation X have little faith in financial firms and financial advisers, according to a study recently released by Charles Schwab. Titled Gen X Money Mindsets, I was not surprised at all by the results. Below is a short comment from this  Coming from the software industry, I had a mandatory introduction to the world of version control software (VCS). Essentially, version control is the concept of securing and archiving many versions of the same file in a multi-user work environment. However, version control shouldn’t exist solely in the domain of software engineers. In fact, financial planning firms can benefit tremendously from implementing a form of version control.

Coming from the software industry, I had a mandatory introduction to the world of version control software (VCS). Essentially, version control is the concept of securing and archiving many versions of the same file in a multi-user work environment. However, version control shouldn’t exist solely in the domain of software engineers. In fact, financial planning firms can benefit tremendously from implementing a form of version control. Several weeks ago I spotted the

Several weeks ago I spotted the  Last weekend I wrapped up an invigorating session of no-holds barred conversation. I was invited to attend the first meeting of folks from across the country that belong to a national study group. All together, there are eleven of us that spent 48 hours discussing anything and everything that was on our collective minds.

Last weekend I wrapped up an invigorating session of no-holds barred conversation. I was invited to attend the first meeting of folks from across the country that belong to a national study group. All together, there are eleven of us that spent 48 hours discussing anything and everything that was on our collective minds.