The Financial Planning Association (FPA®) Board of Directors recently approved changes to its membership structure, most notable of which is an increase of up to $100 in membership dues. The changes become effective on June 1, 2008.

The Financial Planning Association (FPA®) Board of Directors recently approved changes to its membership structure, most notable of which is an increase of up to $100 in membership dues. The changes become effective on June 1, 2008.

Currently there are two main categories of FPA membership; Individual members and Institutional members. The Individual member category includes three segments:

- Financial Planner Members (CFP® certificants or former IAFP members)

- Members (individuals demonstrating a professional interest in financial planning)

- Students (individuals enrolled in a CFP Board-registered program)

Dues for the individual members currently range from $145/year for Students to $295/year for Members and Financial Planning Members.

I have invested many months in an attempt to make the production of quarterly reports much more of a turn-key process in my firm. I am happy to say that by lunchtime on April 2nd, I finished all the quarterly reports and associated workpapers that will be provided to the planners and, ultimately, to our clients. (Update, April 3: Well, I discovered errors within the reports, but they are due to a custom plugin to our Portfolio Management Software,

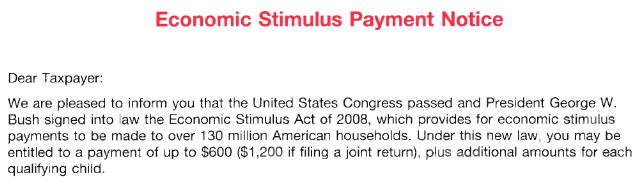

I have invested many months in an attempt to make the production of quarterly reports much more of a turn-key process in my firm. I am happy to say that by lunchtime on April 2nd, I finished all the quarterly reports and associated workpapers that will be provided to the planners and, ultimately, to our clients. (Update, April 3: Well, I discovered errors within the reports, but they are due to a custom plugin to our Portfolio Management Software,  After several notices this year, I finally received my first phishing attempt by folks masquerading as the IRS. Here is their note below:

After several notices this year, I finally received my first phishing attempt by folks masquerading as the IRS. Here is their note below: Oh man, March has been a terrible productivity month for me. I caught a bad cold the week of the 10th and missed most of the week at work. Then I left on the 14th for California for vacation with my wife. Fortunately my health improved as my vacation began, so it wasn’t a complete loss.

Oh man, March has been a terrible productivity month for me. I caught a bad cold the week of the 10th and missed most of the week at work. Then I left on the 14th for California for vacation with my wife. Fortunately my health improved as my vacation began, so it wasn’t a complete loss. Notices from the IRS regarding the Economic Stimulus Payments are now being mailed to taxpayers. In case you haven’t received yours, I uploaded a PDF copy of one.

Notices from the IRS regarding the Economic Stimulus Payments are now being mailed to taxpayers. In case you haven’t received yours, I uploaded a PDF copy of one.

A little more than a week ago

A little more than a week ago  I suppose my blog doesn’t have to revolve around financial planning 100% of the time. Still, financial planners buy plenty of airline tickets to attend national conferences, study groups, and retreats. A little more than one month ago, I started using a tool called

I suppose my blog doesn’t have to revolve around financial planning 100% of the time. Still, financial planners buy plenty of airline tickets to attend national conferences, study groups, and retreats. A little more than one month ago, I started using a tool called  Most people out there are well aware of Congress’ recent action to provide

Most people out there are well aware of Congress’ recent action to provide  Surprise, surprise: members of Generation X have little faith in financial firms and financial advisers, according to a study recently released by Charles Schwab. Titled Gen X Money Mindsets, I was not surprised at all by the results. Below is a short comment from this

Surprise, surprise: members of Generation X have little faith in financial firms and financial advisers, according to a study recently released by Charles Schwab. Titled Gen X Money Mindsets, I was not surprised at all by the results. Below is a short comment from this  Coming from the software industry, I had a mandatory introduction to the world of version control software (VCS). Essentially, version control is the concept of securing and archiving many versions of the same file in a multi-user work environment. However, version control shouldn’t exist solely in the domain of software engineers. In fact, financial planning firms can benefit tremendously from implementing a form of version control.

Coming from the software industry, I had a mandatory introduction to the world of version control software (VCS). Essentially, version control is the concept of securing and archiving many versions of the same file in a multi-user work environment. However, version control shouldn’t exist solely in the domain of software engineers. In fact, financial planning firms can benefit tremendously from implementing a form of version control.