Friday January 20th is “G-Day” where you can discover the value (or lack thereof) of Google’s social network, Google+

Friday January 20th is “G-Day” where you can discover the value (or lack thereof) of Google’s social network, Google+

Social networks have propelled themselves into modern culture, so much so that our lexicon doesn’t bat an eye at words like “tweeting,” “liking,” or “linking-in” anymore.

Abundant, and trivial, information of all kinds is being shared across these networks on a second-by-second basis. They can be a great source of information if you can successfully separate the signal from the noise, but the big three networks are not without their drawbacks.

Facebook, the world’s biggest social network with over 800 million users, wins the ubiquity title because of its critical mass of users. Practically everyone is on Facebook.

But one of Facebook’s drawbacks is the fact that that everybody on the service is your “friend,” whether you’re related by blood or had a chance meeting at a networking event two years ago. It makes little difference to Facebook. You’re connected, so you’ll see updates from plenty of people, and chances are, most updates are not too relevant to your network of actual, real-life friends (though you can group Facebook friends if you can find the lists feature buried in a stockpile of menu items).

Twitter certainly has a healthy stream of information shared by users, but its 140 character limit on posts truncates any real discussion on all-but-the lightest topics. Well-constructed replies often span several tweets, and pretty soon, your stream of well-intended thoughts can be viewed as a diatribe from a spammer filling up a tweet stream.

And LinkedIn. Other than a virtual resume site for professionals, are users doing any real sharing or collaboration on the site? LinkedIn Groups are a mixed bag, as just when the good groups foster useful information, spammers take over and blast their tomes, crowding out the original participants.

Enter Google Plus (Google+, or simply G+). Google’s latest attempt at a social network and sharing service started out slow, with invitations shared only among a select few early-adopters, but now the service is open to anyone.

Google+ attempts to offer alternatives to the limitations outlined above: profile updates can be any length, most often include embedded photos or video, and connections with others can easily be sorted into circles.

Despite its clever interface, Google+ largely lacks the key ingredient to a successful social service: active and diverse users.

So leave it up to Mike Barad. Barad is the Sr. Vice President and business manager for Morningstar’s Financial Communications Business. After a discussion with several advisers sporadically using Google+, he encouraged everyone to abandon all social networking platforms for one day and focus exclusively on Google+.

Here is Barad’s post on Google+: https://plus.google.com/101852363593249198257/posts/e35VNqaJZoy

So this Friday, January 20, get on Google+ and join the conversation. If you’re setting Google+ up for the first time, add advisers who commented on Barad’s post to your circles to get started.

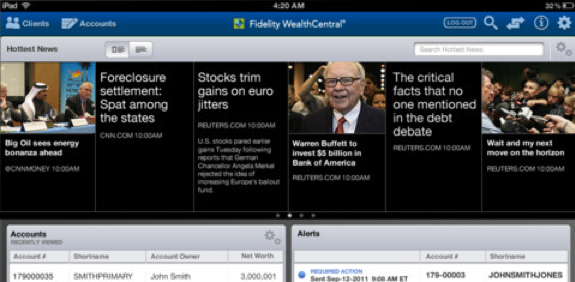

The new iPad’s been out for one week. Here are three features most relevant for advisers.

The new iPad’s been out for one week. Here are three features most relevant for advisers.

Friday January 20th is “G-Day” where you can discover the value (or lack thereof) of Google’s social network, Google+

Friday January 20th is “G-Day” where you can discover the value (or lack thereof) of Google’s social network, Google+

One of the best things I get to do is write the annual Morningstar Advisor Best Tech for Advisers column. I get to reflect on all the new tools, products, and software to which I’ve been introduced over the last 12 months, and choose a select few for consideration for best technology targeted to financial advisers.

One of the best things I get to do is write the annual Morningstar Advisor Best Tech for Advisers column. I get to reflect on all the new tools, products, and software to which I’ve been introduced over the last 12 months, and choose a select few for consideration for best technology targeted to financial advisers.