On today’s broadcast, Schwab and Google drop hints about their online investment services. See how this crowded market is about to become a little bit more cozy. Digital estate planning for your clients is becoming more important than ever. Find out which new solution will help your clients plan for their digital assets. And, Bob Veres gets me fired up about the use of social media in your business. You’ve been warned, prepare for a storm off!

So get ready, FPPad Bits and Bytes begins now.

(Watch FPPad Bits and Bytes on YouTube)

Today’s episode is brought to you by Envestnet | Tamarac, the provider of Tamarac Advisor Xi, a web-based portfolio and client management platform that uniquely integrates portfolio management, reporting, monitoring, rebalancing, and trading with a client portal and enterprise level CRM.

Find out more about Advisor Xi and download their latest white paper on best practices for technology evaluation and implementation by visiting fppad.com/tamarac

Here are the links to this week’s top stories:

Exclusive: Schwab ready to unveil free ‘robo-broker’ service from Reuters, and

Google study heightens fund industry peers from Financial Times (subscription required) or Google Looks to Enter Financial Industry from NBC Bay Area, or Google will likely re-invent the industry rather than play in the existing sandbox from Valuewalk

[This week’s top story covers *two more* announcements in the online investment algorithm space. You did watch last week’s episode, didn’t you? So first up is Charles Schwab who, according to a Reuters article, is developing its own automated investing service for use by you, the financial advisor, to attract emerging clients with a low-cost solution. How low cost you ask? Rumors indicate the service will be free, not including the four to 19 basis points charged by Schwab’s ETFs used in the platform.

And on the heels of Schwab’s news, Google hinted that the company is exploring its own entry into the investment management business. Financial Times first reported that Google commissioned a research report back in September on entering the asset management industry, which trigged a wave of industry speculation that gained a lot of momentum this week.

So let’s take a step back for a moment. Schwab has over 7 million investor accounts with over $1trillion in assets under management and Google has over one billion users across their various online services and mobile devices.

Collectively, the online investment providers have somewhere around $3 billion in assets under management (that’s 3 tenths of a percent of Schwab!) and less than 100,000 users (that’s one one-hundredth of a percent of Google!). Are the disruptors about to be disrupted? I don’t know, you tell me, and it all depends on whom you ask.] Charles Schwab Corp. is weeks away from introducing an automated investing service aimed at winning business from novice investors it does not currently serve, company officials told Reuters.

Estate Assist Wants To Provide Estate Planning For The Social Media Age from TechCrunch

[Next up is an announcement of a new service called Estate Assist, an online safe deposit box, if you will, that stores information about digital assets and shares that information with trusted recipients after a user passes away.

Identifying and managing your clients’ digital assets is probably not a part of your current service model, partly because there really haven’t been any decent solutions out there you can use that are better than using plain old spreadsheets. But with the introduction of Estate Assist, I think it’s time you consider including digital asset management services. Look at my YouTube channel or my email newsletter as an example: if I got hit by a bus <pause>, how will my spouse and beneficiaries access these assets?

In addition to Estate Assist, I think you should look into similar services from PrincipledHeart.com, created by CFP® practitioner William Bisset, as well the data inheritance feature from SecureSafe.] Estate Assist, launches out of beta today. Its aim is to help you store all your online passwords, social media accounts, digital health records, bank info and other paperwork.

The Five Biggest Ways Your Practice Needs to Change from Advisor Perspectives

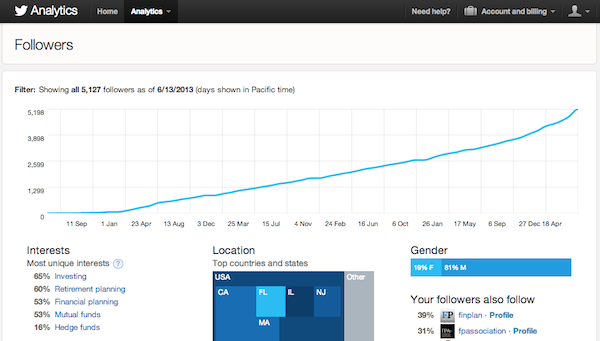

[And finally, this week’s episode wraps up with industry commentary from Bob Veres, as he identifies the biggest ways your business needs to change in a recent Advisor Perspectives column. Now Veres says “pundits and journalists” say you need to make radical transformations, but they don’t give you any specifics. I hope he’s not talking about me, because I try to load these broadcasts you’re watching with tons of resources you should have on your radar. But I digress.

Veres mentions a number of what he calls “genuine evolutionary trends” which are all enlightening in their own way, but buried down at the bottom of his column, he says he suspects that “social media is going to be the least productive in terms of generating business for your firm.”

Really? Now to his credit, Veres says you should play to your strengths, and if social media isn’t one of them, it’s ok.

Well, I think that attitude was valid 20 years ago before it was possible to find out just about anything about anyone online using a quick Google search.

Just look at this broadcast. Complete strangers are watching it, they’re getting consistent value from it, and if they meet me in person at a conference, they say they feel like they already know me. So to say it’s the “least productive” way to generate business.. that’s it, I’m done.] Pundits and journalists make their living telling you that our profession is in a period of rapid evolutionary transition, and exhort you to be open to radical transformation. What you don’t hear in these messages are the specifics.

Here are the stories that didn’t make this week’s broadcast:

Watch all of the videos from Finovate Fall 2014 presentations

Mobile Dossier Startup Refresh Finds A Revenue Model With Its Salesforce App from TechCrunch

Refresh, the mobile tool for making you smarter at meetings, is now positioning itself to help sales teams be smarter about their clients and potential clients. To do that, the company has created a new product for Salesforce’s AppExchange that will allow users to access detailed information about the people in their professional network.