On today’s broadcast, how a business model pivot by a rising wealth management software provider will affect your technology spending, technology experts chime in on the trends that are sure to affect all advisory businesses, new integrations provide marketing resources to grow your online audience, and more.

So get ready, FPPad Bits and Bytes begins now!

(Watch FPPad Bits and Bytes on YouTube)

This week’s episode of Bits and Bytes is brought to you by Total Rebalance Expert, the industry’s largest, privately owned portfolio rebalancing software provider.

Fresh off its acquisition of PowerAdvisor, TRX offers advisors tax-efficient rebalancing, an easy to use interface, and more, all at an affordable price. Learn how you can gain a half a million dollar return on your technology investment by downloading their latest white paper at fppad.com/trx

Here are this week’s top stories:

inStream abandons free plan, introduces subscription pricing from FPPad.com

[This week’s lead story comes from inStream Solutions, which just announced that the company is no longer offering a free subscription plan to financial advisors. inStream first received attention in 2011 by introducing the free financial planning software tool for advisors, with hopes of monetizing advisor participation through an online product marketplace.

But just like many well-known startups including Twitter, Instagram, SnapChat and more seek ways to monetize their platform, inStream shares the challenge of figuring out how to build a sustainable revenue model for its innovative platform.

So the free plan is going away, replaced by a $2,400 annual subscription. Existing users do have the option to subscribe for $1,000 in the first year, and any advisor who signs up by this summer will receive 50% off their first year subscription.

More details about inStream’s pivot as well as the release of a new Safe Savings Rate tool are in this week’s show notes.] Financial planning software startup inStream Solutions drops its free pricing plan, switches to annual subscription model

Technology for Planners: Trends, Spending, and the Rise of Robo Advisers from the Journal of Financial Planning

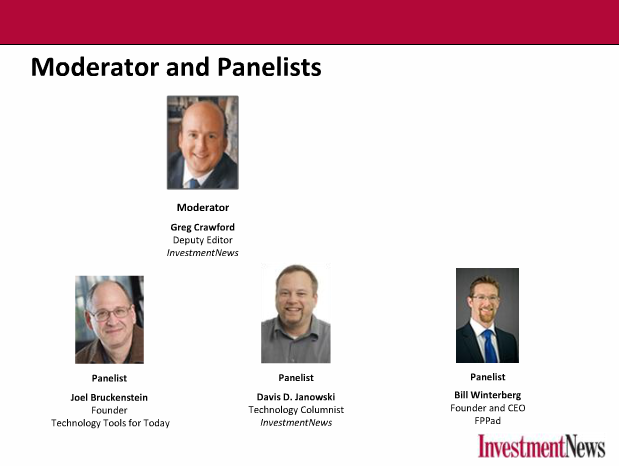

[Next up is a peek into the minds of technology experts in financial services. The cover story of this month’s issue of the Journal of Financial Planning is all about technology for planners; the trends, spending patterns, and rising concern of online “robo-adviser” services.

I had the privilege of joining tech experts Joel Bruckenstein, Jennifer Goldman, and JP Nicols in this roundtable discussion moderated by none other than the venerable Michael Kitces. Be sure you read the roundtable transcript and think about what changes you need to make in your business for 2014 and beyond.] Technology is essential to operating a successful and profitable planning practice. Whether it’s software integration, mobile devices, cloud computing, or the latest on so-called robo advisers, you’ve got questions. The Journal’s practitioner editor, Michael Kitces, uncovers the answers in this roundtable discussion with tech experts Joel Bruckenstein, CFP®, Jennifer Goldman, CFP®, JP Nicols, CFP®, and Bill Winterberg, CFP®

Bill Good Marketing Integrates Gorilla with Redtail CRM

[Now one of the takeaways from the roundtable cover story is that advisors don’t have the budget or venture capital funding to deploy a nationwide marketing blitz. So how can you build your brand and online audience in the face of this competition?

One way is to use content marketing libraries that integrate with your current technology. New this week is the integration of the Bill Good Marketing library into Redtail CRM, giving over 75,000 Redtail users access to compliance-approved marketing material from Bill Good.] CRM systems Gorilla and Redtail Technology collaborate to address major trends affecting Financial Advisors

Exclusive new content & videos from Advisor Websites

[And another offering comes from Advisor Websites, which now offers its “Hall of Famer” users the ability to embed written as well as video content on their website through a partnership with FogLifter.

For more information on the marketing integrations and to view some of the sample content, go to Video 1: Tax & Income Planning http://www.viddler.com/v/1c97c093 and Video 2: Fiduciary Difference http://www.viddler.com/v/479dfc19 .] It’s a new year and big things are happening at Advisor Websites! We are thrilled to announce the addition of new content for all Advisor Websites users!

Unboxing the 2013 Mac Pro: The ultimate desktop for financial advisers from FPPad

[And finally, many of you have asked me what equipment I use to produce each episode of FPPad Bits and Bytes. Well just a few weeks ago, I received my new Mac Pro from Apple and have transferred all of my video editing over to this powerhouse of a machine.

I filmed the unboxing of my Mac Pro and uploaded my review to my YouTube channel this week, so if you’re interested in building your multimedia production capabilities, I suggest you watch the review to see if a Mac Pro purchase makes sense for you. And in case you don’t know, everyone who subscribes to the FPPad newsletter gets my complimentary guide to creating awesome videos. Sign up at fppad.com/subscribe to get your copy today.] The all-new Mac Pro is a powerhouse loaded with processors and memory, but it might (just might) be a little bit overkill for financial advisers

At over 600 attendees, T3 2013 packs downtown Miami with the best in adviser technology

At over 600 attendees, T3 2013 packs downtown Miami with the best in adviser technology