On today’s broadcast, Microsoft introduces the Surface Pro 3 line of tablets. Will the third time be the charm to win adoption from advisors? Cybersecurity remains a hot topic in financial services. Read what one compliance attorney says are the worst security practices he’s ever seen. And, advisor matchmaking websites are popping up everywhere. Will any of them reach critical mass to successfully match prospects with the right advisor?

So get ready, FPPad Bits and Bytes begins now!

(Watch FPPad Bits and Bytes on YouTube)

Today’s episode is brought to you by ITEGRIA, providers of complete outsourced technology support, security, infrastructure and IT solutions exclusively for RIAs.

To learn how you can keep your data safe from attackers, download a free copy of their latest white paper on social engineering attacks by visiting fppad.com/itegria.

Here are the links to this week’s top stories:

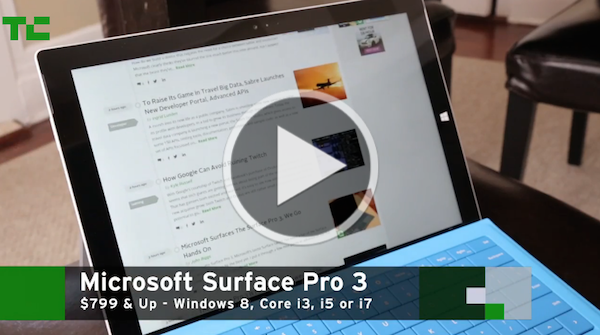

Fly Or Die: Microsoft Surface Pro 3 from TechCrunch

[This week’s top story comes from Microsoft, as the company recently introduced its third generation of Surface Pro tablets due out by mid to late June. The entry level Surface Pro 3 comes with the Core i3 processor and 64GB of storage, starting at $799, but a fully loaded Core i7 version with 512 GB of storage will set you back almost $2,000 and it doesn’t include the detachable Type Cover, which runs an additional $129.

Microsoft is using its Surface Pro 3 to take aim at the Apple MacBook Air line of popular ultra-thin laptops. While the Surface Pro 3 is lighter than the 13” MacBook air, offers a touch display, and has a removable keyboard, the fully-loaded version runs nearly $300 more than the top of the line MacBook Air.

Still, the latest Surface runs Windows 8 natively, supports Microsoft Office, and poses fewer compatibility issues with proprietary broker-dealer or custodial software that often requires Internet Explorer.

But at 18% taller and 22% wider than the iPad Air, to me the Surface really isn’t a tablet as much as it is a touchscreen laptop with a detachable keyboard. It remains to be seen whether the Surface Pro 3 will gain adoption from advisors, or languish when compared with the more traditional Windows laptops from manufacturers like Dell, Lenovo, and others.] Forget everything you thought you knew about the Microsoft Surface tablet, as the latest generation of the Windows-powered Surface Pro is a clear step up from the Microsoft slates of yore.

Microsoft Surface Pro 3 review: A legitimate work PC in tablet clothing from PCWorld

Through every iteration, Microsoft’s Surface Pro tablet has edged closer to becoming a true laptop replacement. Microsoft’s latest Surface Pro 3 takes several small steps in that direction—along with one giant, game-changing leap.

Experts: Financial Advisers Lax on Cybersecurity from WSJ.com

[Next up is a timely article on poor cybersecurity practices among financial advisors. In a Wall Street Journal column, Brian Hamburger, compliance attorney and chief executive of MarketCounsel, identified several dangerous issues he’s seen when visiting advisory firms.

The innocent, but dangerous, practices include things like writing down passwords on sticky notes, failing to reset passwords when an employee leaves the firm, and not encrypting laptop hard drives.

Couple that with the dramatic increase in client spoofing, where hackers break in to client email accounts to request fraudulent money transfers, and you have a recipe for some substantial financial losses as well as the loss of client trust.

Regarding passwords, my advice is to treat them like a pair of boxer shorts. Yes, boxer shorts: Keep them a mystery, don’t share them, don’t leave them lying around, and please, change them often!] When consultant Brian Hamburger visits financial advisory firms he often sees a practice as innocent as it is dangerous: Passwords posted on computers to help advisers remember them.

‘Match.com’ for advisers and clients expands to San Francisco from InvestmentNews

[And finally, there are a number of new websites that have recently launched to match consumers seeking financial advice with financial advisors. You may already be familiar with services like Paladin Registry or WiserAdvisor.com, and to a lesser extent, the advisor search features from the FPA and NAPFA.

But recently, InvestmentNews highlighted the latest entrant into the field called GuideVine. The service follows a similar theme to existing advisor matchmaking websites, but GuideVine offers embedded video introductions along with standard written biographies to help consumers get a feel of each advisor’s unique characteristics.

Now I support any and all websites that have the objective of connecting clients with advisors that are right for them, but I think advisors would be wise to invest time and energy building their own online resources, which include a blog, active social media profiles, and even a YouTube channel.

I feel it’s key to be visible in the places where your potential clients are active every day, and to me, the advisor matchmaking sites just don’t have the large audiences that are found on LinkedIn, Twitter, YouTube and more.] GuideVine, a technology startup that wants to connect advisers with consumers seeking financial advice, started operations on Thursday in San Francisco after a successful New York launch in March.

And here are stories that didn’t make this week’s broadcast:

Voices: Katie Stokes, on Getting Rid of the Quarterly Report from WSJ.com (free preview)

With real-time market and investment available online to every client, the quarterly report is an obsolete mode of data delivery.

Riskalyze and United Planners Launch Partnership from Yahoo Finance

United Planners Financial Services (UP), a national RIA and independent broker-dealer partnership with more than 350 advisors nationwide, and Riskalyze, the creator of the Risk Number™, today announced a partnership to equip every UP advisor with industry-leading Client Risk Profile technology to pinpoint client risk tolerance.