Today is the second and final day of FinovateSpring 2012. Be sure to read my highlights of Day 1.

Here are today’s best takeaways for financial advisers.

(updated 10:27PM PDT)

Pindrop Securiity uses acoustic forensics to identify fraudulent and spoofed phone calls

[Last month I posted Why financial advisers can’t trust their clients anymore, as hackers are using more sophisticated methods to “spoof” clients’ identity and steal money. Some hackers use Caller ID spoofing to display a victim’s phone number in an attempt to fool an adviser into believing the incoming call is legitimate. Pindrop Security now offers a way to use acoustic forensics to examine over a hundred characteristics of incoming phone calls. They look for call characteristics like transmission over cellular networks versus voice-over-IP (VoIP), geolocation information, and more. While it’s likely targeted to call centers with high call volume, I wouldn’t be surprised if a tool like this trickles down to independent financial advisory firms who need such security capabilities.]

FutureAdvisor Announces its Premium Beta from Finovate.com

[I spoke with FutureAdvisor co-founder Bo Lu and filmed the interview for my YouTube channel. I should post it sometime next week. In the meantime, FutureAdvisor is another direct-to-consumer online advice platform, but is focused on servicing the defined contribution 401(k) market. At Finovate, they changed their business model by offering its Premium subscription tier for free while in beta, which previously cost $149 per year.] Kicking off the final afternoon session, FutureAdvisor showed how its new platform gives actionable investment advice.

(updated 1:35PM PDT)

inStream Shows How it is Changing the Financial Planning Software Industry from Finovate.com

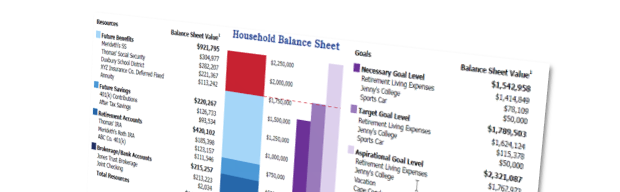

[After opening their product to advisers last year, inStream Solutions, the proactive financial planning software application, now has over 800 firms representing $200 billion in assets under advisement on board. I filmed inStream CEO Alex Murguia here at Finovate and will post the video to YouTube in the next week.] inStream is changing the market standard for what is generally referenced today as “financial planning software” through multiple innovations

(updated 11:14AM PDT)

Would you rather watch football instead of planning for retirement? This app’s for you.

[Here’s an interesting take on financial education and planning tools; combine football concepts with finance. Portfolio Football is a platform that invites users to make a fantasy football “team” (aka portfolio) of 11 “players” (aka stocks, mutual funds, and ETFs). With a fantasy team assembled, Portfolio Football delivers allocation summary and performance graphs to show how this portfolio has performed in the past. It’s interesting, but I didn’t get a feel of how Portfolio Football determines what “players” would be appropriate on a “team” across a variety of investors, and whether or not 11 is a magic number of players. I give them credit for focusing on a very specific niche, though; the fantasy football community!]

(updated 10:02AM PDT)

Transparency Labs Helps Retirees Maximize Savings from Finovate.com

[What Brightscope did for retirement plan ratings, Transparency Labs seeks to do for retirement plan disclosure language. Have you ever read all the fine print about how your 401(k) works? Me neither. While intriguing, clients that engage financial advisers have an edge, as advisers generally counsel clients on the penalties of cashing out 401(k) accounts prior to reaching retirement. But for the rest of America, this can be a useful tool to help plan participants keep more of their money.] Transparency Labs addresses America’s “Cash-Out Crisis” by helping retirement savers understand the penalty, fee and tax implications of cashing-out their retirement savings as they change jobs

(updated 9:42AM PDT)

BehavioSec Uses Behavioral Analytics to Tackle Mobile Security from Finovate.com

[You have client data loaded on computers, phones, and tablets. By and large, sensitive data is protected by a basic username and password login. What BehavioSec does is apply a transparent layer of security protection that samples the behavior of how a user interacts with a device and types passwords into the system. BehavioSec calculates a confidence score in real time, and if the input behavior doesn’t match the user’s behavior, access is denied. Definitely cool software for security.] BehavioSec demonstrated its mobile security solution that uses behavioral analytics.

I’m attending FinovateSpring 2012 today and tomorrow. When I have a chance, I’ll update FPPad with items independent financial advisers will want to add to their radar.

I’m attending FinovateSpring 2012 today and tomorrow. When I have a chance, I’ll update FPPad with items independent financial advisers will want to add to their radar.