Check out this awesome tshirt from Carl Richards over at BehaviorGap.com.

Kevin Keller Defends the Integrity of the CFP® Mark

Interesting developments have occurred over at Financial Advisor magazine’s online extras this week. First, on April 6, Dr. Somnath Basu wrote an article titled Restoring Trust in the CFP Mark. I encourage you to read it.

While Dr. Basu is correct that the industry needs to do better in its service to clients, he lumps CFP® practitioners together with all financial service professionals, whether they be regulated or not.

So in response, CFP Board CEO Kevin Keller published a response to Dr. Basu titled In Defense of the CFP Mark. Keller clarifies several of Dr. Basu’s misconceptions in his original article and stresses how all advisers must operate with “full accountability and transparency” to clients.

Take a few mintues to read these articles and post comments on FA Magazine’s website.

Update: Now read this post by Dr. David Edward Marcinko at the Medical Executive Post. Dr. Marcinko finishes his comments with this:

And so, why do I shake my fist at Somnath Basu? It’s admittedly with congratulations, and a bit of schadenfreude, because he wrote an article more eloquently than I ever could, and will likely receive much more publicity [good or slings-arrows] for doing so. You know, it’s very true that one is never a prophet in his own tribe. Oh well, Mazel Tov anyway for stating the obvious, Somnath. The financial services industry – and more specifically – the CFP® emperor have no clothes! Duh!

A New Addition to the FPPad Family

Ok, now I’ll really be on a temporary hiatus from blogging. I’ll be updating more frequently once my schedule returns to normal (will that ever happen?!?).

My wife and I welcomed our new baby boy into the world on March 28, 2009 at 11:23 AM. Enjoy the photos below:

Brief Hiatus; Follow the Action on Twitter

Posted with QuickPress:As I mentioned earlier this month, I’m training new staff and giving several presentations to professional organizations. As such, blog updating has taken a back seat. I plan to be back in April with insight on TWR performance reporting flaws, custodian captivity concerns involving custom tools, and a review of Smarsh’s recently unveiled CRM.

Until then, you can follow my micro updates on Twitter.

Blogging for Fun and Profit

If the title of this post seems familiar, that’s because I took artistic license and modified Tim Ferriss’ original title to the Four Hour Work Week, Drug Dealing for Fun and Profit.

I do blog for fun, but I don’t blog for profit. Note that there are zero ads from Google or any other type of marketing on FPPad.

Since it’s a pastime of mine, sometimes blogging takes a back seat to the other priorities that consume my day. Since I’m deep into staff training, managing trading in volatile markets, and preparing several presentations to advisers on technology and social media, I’m going to highlight some of the more popular FPPad posts that have been drawing a lot of traffic in the event you’ve missed them.

And I’ll return with new content that I have in process soon.

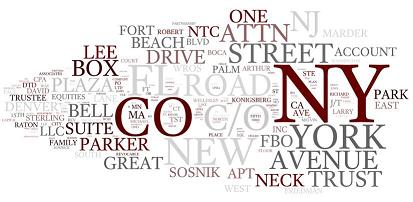

Bernie Madoff Victim Tag Cloud

Don’t have enough time to sift through the 163-page list of Bernie Madoff victims?

Once again, tag clouds to the rescue. I took all the text from the PDF and loaded it into Wordle, here are the results:

Use Tag Clouds to Identify Common Threads

I’m attending Andrew Gluck’s Financial Crisis Webinar today featuring Mark Tibergien, CEO of Pershing Advisor Solutions, LLC.

I’m attending Andrew Gluck’s Financial Crisis Webinar today featuring Mark Tibergien, CEO of Pershing Advisor Solutions, LLC.

Part of what Andrew did was use a short survey to gather feedback from people who registered for the webinar

Read Andrew’s blog How Advisors Are Responding to the Crisis.

Andrew listed many comments from advisers that feature all sorts of strategies and ideas. It’s a lengthy list, and I must admit, I didn’t get a sense of what the majority of respondents were doing.

Enter the Tag Cloud.

How Demanding Are Your Firm’s Year-End Processes?

I apologize for the infrequent updates lately to FPPad. So what’s been keeping me so busy in the last few weeks?

I apologize for the infrequent updates lately to FPPad. So what’s been keeping me so busy in the last few weeks?

The end of a calendar year is especially busy for most independent wealth management firms, and ours is no exception. Between closing the books, communicating quarterly estimated tax payment information, creating client reports, and calculating fees, there are lots of processes and procedures to follow to ensure that nothing falls through the cracks.

In addition, when I’m out of the office, I’m very busy coordinating the final sessions for the FPA of Oregon & SW Washington’s annual Mid Winter Conference, plus I’m teaching AARP TaxAide classes every Saturday. So I think I have good excuses for not posting!

IRS Revenue Procedure May Affect Client REIT Holdings

I recently learned about a recent IRS Revenue Procedure from one of our custodians. The document is Revenue Procedure 2008-68 and addresses the concern REITs (Real Estate Investment Trusts) have regarding their ability to satisfy the taxable income distribution requirements.

I recently learned about a recent IRS Revenue Procedure from one of our custodians. The document is Revenue Procedure 2008-68 and addresses the concern REITs (Real Estate Investment Trusts) have regarding their ability to satisfy the taxable income distribution requirements.

A REIT is required to distribute 90% of its taxable income, including any net capital gains, to its shareholders each year. If it fails to do so, the REIT may lose its ability to reduce or eliminate its corporate income taxes. Due to the credit crisis affecting the economy, REITs are struggling to raise enough capital in order to distribute the mandatory 90% of taxable income in cash.

As a result of the procedure, the IRS will now allow REITs to distribute stock, in addition to cash, as a dividend and the entire amount will be treated as satisfying the REIT distribution requirements.

What does this mean for you and your clients?

Bulk Trading, Tax Training, and Career Planning

Updates will be rather sparse for the rest of the week, both to FPPad and to Twitter.

Updates will be rather sparse for the rest of the week, both to FPPad and to Twitter.

Bulk Trading

So far for the week, I’ve coordinated a bulk trading effort at our firm to capture losses in taxable accounts where we can execute orders across the entire book of business. We have multiple custodians, so I’ve had to build some flexibility in the trading techniques to ensure compatibility with the custodians’ preferences. Still, we’ll be executing almost 20% of last year’s annual trading volume in just a day. Not bad considering we don’t have the luxury of Tamarac or iRebal.

Tax Training