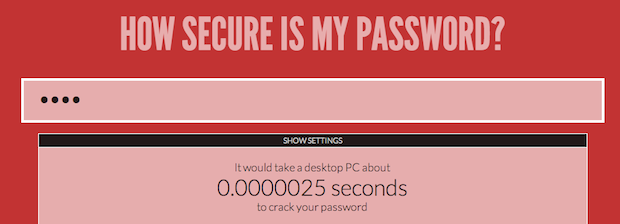

Before I kick off this week’s top stories, here’s a quick and easy resource to use to see how strong your password is against a brute-force attack. Click the image to visit http://howsecureismypassword.net/

Note: You should probably avoid typing your real password into this program. Instead, use a close approximation!

Here are this week’s stories of interest:

Social Media Minute Podcast by RegEd: LinkedIn Skill Endorsements from RegEd.com

[In this seven-minute podcast, RegEd’s Blane Warrene addresses issues with LinkedIn Recommendations and Endorsements. It’s a good overview for those dipping a toe in LinkedIn and a good refresher for social media pros.] A rapidly trending topic continues to be LinkedIn Skills Endorsements. They are a much more gray area than Recommendations as it pertains to being classified as testimonials under SEC guidelines for the financial services industry.

Microsoft Eyes “Advisor in a Box” Solution for Windows 8 from Financial-Planning.com

[Why am I such a skeptic when it comes to Microsoft products these days? Who knows more about meeting the specific needs and demands of today’s financial planning and wealth management client? You, or Redmond’s Mister Softee? However, I’m more optimistic of a partnership like the ones identified with Envestnet|Tamarac, because they do know a thing or two about what advisers need.] Thomas E. Feher, the financial services industry director for Microsoft’s U.S. Dynamics Industry Team, said Microsoft has already partnered with several “industry partners,” including Envestnet|Tamarac and Salientia to provide CRM solutions to advisors through the Windows 8 platform. But, he said, the next step is a preloaded package of tools and services specifically tailored for each advisor on the Windows 8 platform.

Orion Mail is Live from OrionAdvisor.com

[You heard about Orion Mail from both Eric Clarke (see: Salesforce, powered by Orion Connect, gets phone system integration and smarter email reports) and Jon Reiners (see: TD Ameritrade’s open technology helps push Orion Advisor Services over the $100 billion in platform assets mark). Now the feature is live for Orion’s 300 clients and was being demoed on the floor of T3 this past week. Orion’s blog has a 90-second sneak peek video of the new feature.] Orion Mail enables advisors to create custom email templates that communicate account information to clients quickly and easily.

Bill Winterberg’s Technology Planning Tips for Financial Advisors from AdvisorWebsites.com

[Advisor Websites contacted me a few weeks ago to capture some of my best technology ideas for new gadgets, video content, and software integration.] Recently we were lucky enough to sit down with Bill Winterberg and pick his brain about the changing industry and what he expects will be key, vital factors when it comes to technology for financial professionals in 2013.

How Blueleaf sees itself taming the RIA’s two betes noire — and how it is being challenged on that from RIABiz.com

[You’ve known about Blueleaf since mid-2011, right (see: FPPad and Blueleaf Partner to Deliver Adviser Technology Content)? And plus, I interviewed Blueleaf founder John Prendergast in February 2012 (see: Video Spotlight: John Prendergast of Blueleaf discusses experimentation and challenging assumptions). Here, RIABiz covers the “dead simple” portfolio reporting provider (important distinction: it’s NOT portfolio management!) in a well-balanced article.] Blueleaf founder, John Prendergast, comes by this start-up honestly in the sense that it arose out of a need he heard expressed by friends. He exudes a teflon confidence that is a much a part of this article as anything else.