It was a slow week in financial planning technology news, but thankfully, December marks the release of the annual Financial Planning Technology Survey. Joel Bruckenstein’s review of what tools and technology advisers are using dominates this weeks update. Otherwise, companies must be entering that post-Thanksgiving quiet period in advance of the December holiday season.

It was a slow week in financial planning technology news, but thankfully, December marks the release of the annual Financial Planning Technology Survey. Joel Bruckenstein’s review of what tools and technology advisers are using dominates this weeks update. Otherwise, companies must be entering that post-Thanksgiving quiet period in advance of the December holiday season.

Here are this week’s stories of interest:

Tech Survey from Financial-Planning.com

[Redtail leaps ahead of CRMs, advisors flock to iPads, and firms still operate without any form of real document management. Read this and other insights in Bruckenstein’s annual review.] From iPads to Androids to cloud providers, technology evolves oh-so-fast, and FP’s annual tech survey reveals that advisor technology usage is changing rapidly too.

Advisor Tech Survey: Tablets Are What’s Hot Now from Financial-Planning.com

[When I spoke to a room full of advisers at NAPFA Connections in Dallas last month, over 80% of them raised their hands when asked if they owned an iPad. How much more proof does one need?] For financial advisors, the introduction of iPad over the past year has changed everything. Notoriously resistant to new technologies, advisers have become envious of the remarkable advancements taking place in the consumer tech market.

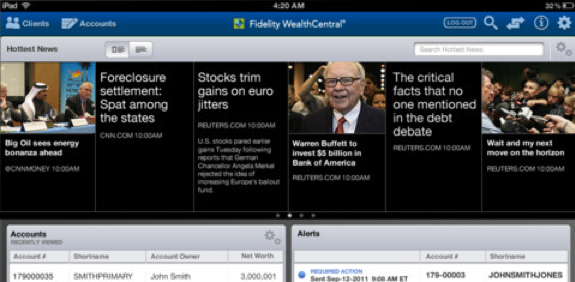

UBS Gets Serious About Mobile With iPad App Test Drive from Financial-Planning.com

[Financial advisers affiliated with UBS Wealth Management Americas will soon have access to the UBS FA Mobile app for iPad. Perhaps the intro sentence would be better if the hope was to create more effective engagements with clients. AUM growth is just a side effect of that.] Some 60 UBS Wealth Management Americas financial advisors will kickoff a three-month test drive this week of an iPad application designed to make it easier to interact with clients and access research reports — all in the hope of generating more assets under management.

The Mitigator from Financial-Planning.com

[How do you manage $300+ million AUM with just a staff of three? Get Tamarac Advisor X and leverage ByAllAccounts.] When a Midwestern regional bank bought the independent firm financial planner Marc Henn worked for in 2002, his clients questioned where their interests ranked on the firm’s list of priorities. “My clients encouraged me to start my own firm,” Henn says. In 2008, he did, founding Harvest Financial Advisors of West Chester, Ohio.

The new iPad’s been out for one week. Here are three features most relevant for advisers.

The new iPad’s been out for one week. Here are three features most relevant for advisers.

It was a slow week in financial planning technology news, but thankfully, December marks the release of the annual Financial Planning Technology Survey. Joel Bruckenstein’s review of what tools and technology advisers are using dominates this weeks update. Otherwise, companies must be entering that post-Thanksgiving quiet period in advance of the December holiday season.

It was a slow week in financial planning technology news, but thankfully, December marks the release of the annual Financial Planning Technology Survey. Joel Bruckenstein’s review of what tools and technology advisers are using dominates this weeks update. Otherwise, companies must be entering that post-Thanksgiving quiet period in advance of the December holiday season.