On today’s broadcast, Microsoft discloses a zero-day vulnerability that affects nearly all Windows operating systems. See what you need to do right now to protect your systems from attack. inStream inks a partnership with BAM Advisor Services. Learn why this could be a big deal for the startup wealth management software provider. And, cyber attacks scare even the most security-conscious advisors. Find out about a new assessment service that can help defend your business from online attacks.

So get ready, FPPad Bits and Bytes begins now.

(Watch FPPad Bits and Bytes on YouTube)

Today’s episode is brought to you by ITEGRIA, providers of complete outsourced technology support, security, infrastructure and IT solutions exclusively for RIAs.

In their new book titled Red Flags, you’ll learn how to protect your firm from cyber-attacks, disasters, and IT compliance risks. Learn more about the Red Flags book by visiting fppad.com/itegria.

Before I get to the links to this week’s top stories, first answer this live poll:

Now on to this week’s top stories:

What you need to know about new zero day that hits most supported Windows versions from PCWorld.com, and

(Install) Microsoft security advisory: Vulnerability in Microsoft OLE could allow remote code execution: October 21, 2014 from Microsoft TechNet

[This week’s top story involves the hot topic of cybersecurity, as Microsoft disclosed a scary vulnerability in nearly every version of Windows on the market. So if you’re watching on a Windows machine, you need to pay attention. Mac users, you can go top off your Halloween candy.

Ok, so the vulnerability allows attackers to exploit Microsoft’s Object Linking and Embedding technology, better known as OLE, by sending you a Microsoft Office file with malicious code inside. If you open document, the attacker can gain access to your account’s rights and permissions and can remotely execute code on your computer. The potential for damage isn’t that great if your account has limited permissions, but if your account has administrative rights, then really bad things can happen. Pretty scary, huh? (scream)

So here’s what you need to do right now: first, remind everyone in your business once again never to open suspicious Microsoft Office documents, especially PowerPoint files, that are attached to dubious emails.

Then, to patch this vulnerability, head over to fppad.com/145 to find the link to Microsoft’s Security Advisory that contains the instructions on how to get the update. Now would also be a good time to make sure you’re current on all of your Windows updates.] Microsoft issued a security advisory this week with details of a zero day vulnerability that affects every supported version of the Windows operating system with the exception of Windows Server 2003.

Buckingham Asset Management & BAM Advisor Services announces selection of inStream wealth management technology platform from Yahoo Finance

[Ok Mac users, you can come back now, because next up is a story from Buckingham Asset Management and BAM Advisor Services, as the joint companies announced the selection of inStream as its wealth management platform for their 370 affiliated advisors.

You have to go way back my episodes in January for news on inStream, when the company announced that it would switch from a free plan to one that costs roughly $2,400 a year to use. But under the new strategic partnership, advisors who are part of the BAM Alliance will have full access to the inStream platform for no additional cost.

This is a big deal for inStream, as Buckingham Asset Management and BAM Advisor Services collectively manage or administer over $23 billion in assets, making them one of the largest RIAs in the country. So you might want to raise inStream a little bit higher on your radar, as I expect you will be hearing more from the company regarding new partnerships and financial planning functionality.] Buckingham Asset Management/BAM Advisor Services, one of the country’s largest independent wealth management enterprises, has chosen the inStream planning-centric wealth management software platform to serve the more than 370 advisors representing the more than 140 client firms in its network.

Investment Technology Partners Begins Offering Cybersecurity Assessments to Independent RIAs from PRWeb

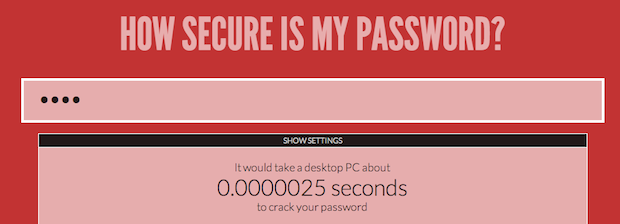

[And finally, cybersecurity raises its ugly head once again to finish this week’s episode, but this time the news comes from Investment Technology Partners, a cloud IT provider to RIAs. Earlier this week, ITP announced it is now offering IT infrastructure assessments to RIAs to identify ways you can proactively build up your defenses against online attacks.

ITP’s assessment consists of a pre-visit questionnaire, an onsite inspection, and a post-visit follow-up, all in an effort to help you update your policies and procedures to address cybersecurity risks. Back in episode 129, I told you about the SEC’s new cybersecurity initiative and potential for increased enforcement around this area, so if you’ve been sitting on your hands since then, let this serve as another reminder that you now have a variety of providers you can engage to navigate you through this challenging landscape. In addition to ITP, popular cybersecurity audit providers include Itegria, Envision RIA, External IT, True North Networks, Right Size Solutions, and more.] Investment Technology Partners, an outsourced cloud IT provider focused in the Independent Registered Investment Advisory marketplace has begun conducting IT infrastructure assessments for RIA firms who have engaged them be sure their firms can positively respond to the an SEC audit looking into cybersecurity policies.

Here are the stories that didn’t make this week’s broadcast:

http://online.wsj.com/articles/td-ameritrade-offers-robo-technology-to-advisers-1414013725 from WSJ.com

TD Ameritrade Offers Robo Technology to Advisers from WSJ.com

TD Ameritrade AMTD +0.39% is making robo technology available to the 4,000 independent registered investment advisers who use its custody and trade clearing services. The technology is coming from a fledgling San Francisco firm, Upside Financial LLC, and is in the final stages of being added on to the Omaha, Neb.-based brokerage firm’s systems that are used by independent advisers to manage client money.

United Capital Picks Up $320M California RIA from WealthManagement.com

A strategic partnership between United Capital and the founders of financial planning tool FlexScore led United Capital acquiring a Modesto-based firm with $320 million in assets.

Inbox from GMail: The inbox that works for you

Built on everything we learned from Gmail, Inbox is a fresh start that goes beyond email to help you get back to what matters.

Junxure Enhances Its Cloud CRM from ThinkAdvisor

Junxure has released an enhancement to Junxure Cloud, the first major upgrade to the cloud-based CRM program used by RIA firms and broker-dealer reps since its launch this summer.

Encryption: What Advisors Need to Know from Financial Planning

Encrypt sensitive information, planners are routinely warned by security experts. Many states even require it. But there’s also confusion out there among advisors about the nuts and bolts of encryption.

Erado Announces Expanded Partnership with Investacorp from Digital Journal

Erado, an innovator in electronic communication compliance, announced today that it has expanded its partnership with Investacorp, Inc., to include Erado’s email archiving and all-encompassing social media compliance platform.