On this week’s broadcast, learn the hits and misses from the year’s most anticipated advisor technology survey, the pending termination of several financial planning software products catches advisors off guard, how the leading independent custodians are stepping up their technology, and more.

So get ready, FPPad Bits and Bytes begins now!

(watch FPPad Bits and Bytes on YouTube)

This week’s episode is brought to you by Angie Herbers Incorporated, a consulting and research company to financial advisory firms, who just released a new white paper called Take Two: The New Direction of Succession that addresses the key elements to create a successful transition to your junior advisors.

Download the Take Two white paper for free, along with other practice management resources, by visiting fppad.com/ahi

Here are this week’s top stories:

Tech Survey 2013: What’s New iIn Advisor Tech? from Financial-Planning.com

[Leading off as the top story is one of the most anticipated technology articles that comes out every year. The first of December marks the release of the annual Financial Planning Magazine Technology Survey, where Joel Bruckenstein digests over 1,100 responses about the various software programs and practice management tools used by financial advisors today.

So who are the winners and losers from this year’s survey?

Redtail Technology, Salesforce, and Tamarac Advisor CRM are the winners among CRM software, as advisors continue to embrace cloud-based technology, with slippage coming from Junxure, ProTracker, ACT, and Goldmine.

In financial planning software, this year’s results are essentially a carbon copy of last year’s survey, with MoneyGuidePro, eMoney, and MoneyTree claiming the top three spots.

And the same is true with portfolio management software, as the top 6 vendors are also a total repeat of last year’s results.

So who missed out on opportunities this year? The survey randomly selected new products from Blueleaf, inStream, and Market76, but found that few advisors had even heard of these relatively new players, which tells me that financial advisors, well, those who don’t watch Bits and Bytes, continue to be a challenging market for new providers to gain exposure.] The move to the cloud is finally taking place. In category after category of this year’s Financial Planning Tech Survey, we found software providers making the shift, and advisors responding.

NaviPlan financial planning desktop products to be discontinued from InvestmentNews

[The next story features news from Advicent Solutions, the company formerly known as Zywave, who provides a suite of financial planning software to advisors under the NaviPro brand.

In an unexpected announcement to some users, the company announced it will sunset six of its NaviPlan products on March 31, 2014, citing an “ever-changing marketplace.”

Going away will be all of the NaviPlan Extended and NaviPlan Standard desktop-based variants, making the cloud-based NaviPlan Premium and NaviPlan Profiles the sole applications that will receive ongoing support and enhancements in 2014 and beyond.

This news reinforces the trend of advisors adopting cloud-based solutions as seen in the Financial Planning Software Survey, so don’t be surprised when other providers announce the discontinuation of their own desktop-based software in favor of cloud-based alternatives.] NaviPlan financial planning products for desktop computers will be discontinued as the owner develops its NaviPro products for online use.

Plowing Ahead from FA-Mag.com

[Software providers aren’t the only ones making big changes in advisor technology, as four of the major custodians are also investing heavily in advisor-facing technology in a very competitive arms race. Once again, Joel Bruckenstein interviewed executives from Fidelity, Pershing, Schwab Advisor Services, and TD Ameritrade Institutional to reveal their strategies to help make advisors more efficient and more profitable through enhanced technology.

There’s a ton of great information in this article, so be sure to read it to see what your custodian is doing to help you grow your business.] Over the last several years, custodians have been investing in advisor-facing technology like never before.

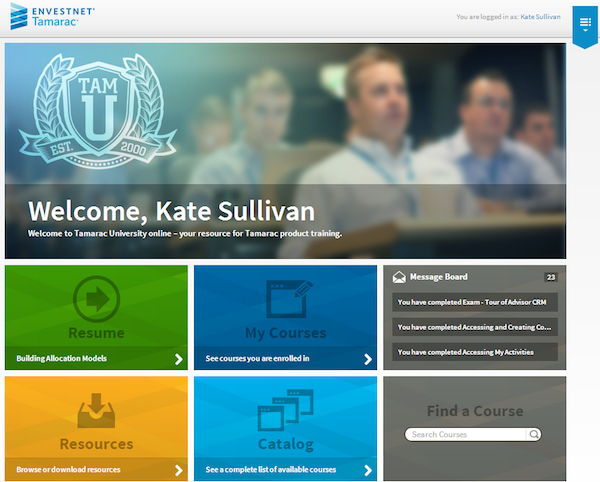

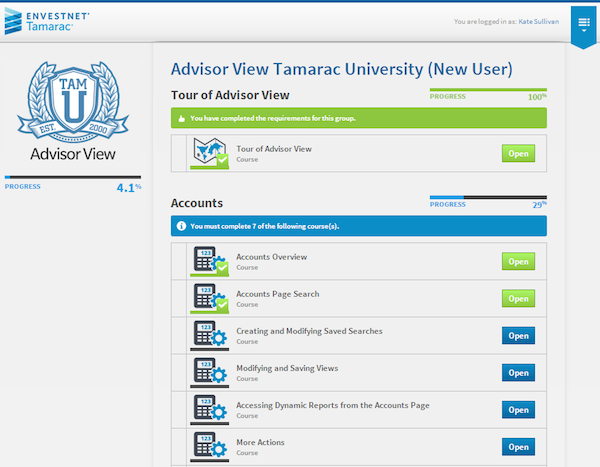

Envestnet | Tamarac’s Advisor Xi(R) Platform Added To Pershing’s NetX360(R) Technology Channel from WSJ.com

[And finally, one company benefiting from custodian technology enhancements is Envestnet|Tamarac. This week, the company announced that its Advisor Xi suite will soon integrate directly with Pershing’s NetX360 custodial platform, giving advisors straight-through processing capabilities for trades in accounts held at Pershing, as well as access to real-time custodial account data.

The real-time data feeds will compliment existing integrations with Schwab and TD Ameritrade supported today, and expand straight-through processing trading capabilities announced at Schwab IMPACT several weeks ago.

Tamarac anticipates that the new integrations will roll out to its 660 firms during the first quarter of 2014.] Envestnet | Tamarac, a division of Envestnet, Inc., a leading provider of integrated, web-based portfolio and client management software for independent advisors and wealth managers, announced today that it has formally begun the integration of its Advisor Xi(R) platform into Pershing’s NetX360(R) custodial channel for investment professionals and Registered Investment Advisors (RIAs). Advisors will have access to this integration in the first half of 2014.