On this week’s broadcast, learn which broker-dealers are stepping up their game in technology, the industry’s first native financial planning app for Salesforce is introduced, what to do when someone steals your online videos, and more. So get ready, Bits and Bytes begins now.

Today’s episode is brought to you by the 2013 T3 Enterprise Conference, exclusively designed for the technology needs of broker-dealers and financial enterprises.

You have less than one month before this event kicks off on November 3rd in Chicago, so if you’re looking for the best place to monitor trends in broker-dealer technology, you need register today at t3enterpriseconference.com

Upping the Ante from Financial Advisor Magazine

[Continuing with the theme of broker-dealer technology, this week’s lead story comes from Joel Bruckenstein, whose “Upping the Ante” column for Financial Advisor magazine provides a terrific overview at what broker-dealers are doing to deliver leading technology to their representatives.

Bruckenstein covers updates from leading BDs like Raymond James, LPL Financial, United Planners, Commonwealth, and Wells Fargo Advisors. Even if your firm is not affiliated with a broker-dealer, you need to read this column to find out what technology you should be adding to your business so you don’t fall behind in this continuously evolving marketplace.] With advisors’ business models constantly evolving, the pressure on independent broker-dealers to continually enhance their technology platforms has never been more intense. From portfolio management to client relationships, advisors are demanding that competitive brokerage firms up their tech games. This article looks at how five broker-dealers are trying to satisfy those demands.

Advisor Software, Inc. Launches goalgamiPro On salesforce.com’s AppExchange, The World’s Leading Business Apps Marketplace from PRNewswire.com

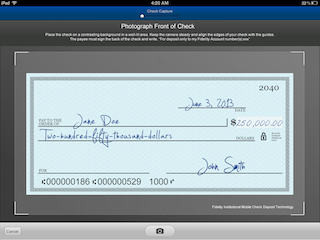

[Now notably absent from an article on broker-dealer technology is any update on Salesforce, the 800-pound gorilla of enterprise CRM. But one company expanding its support of Salesforce is Advisor Software, creators of goalgamiPro, a quick financial planning software application that I’ve highlighted in the past on my YouTube channel.

Advisor Software just launched a new app in the Salesforce AppExchange for goalgamiPro, giving advisors who use Salesforce the industry’s first native financial planning app for the CRM platform. You can watch a 7-minute demo video of goalgamiPro for Salesforce in action embedded along side the links to this week’s top stories.] Advisor Software, Inc., a provider of wealth management solutions for the financial advisor market, today announced it has launched its goalgamiPro quick planning solution on salesforce.com’s AppExchange, empowering businesses to connect with customers, partners and employees in entirely new ways.

Video theft: the latest threat to online financial adviser content from FPPad

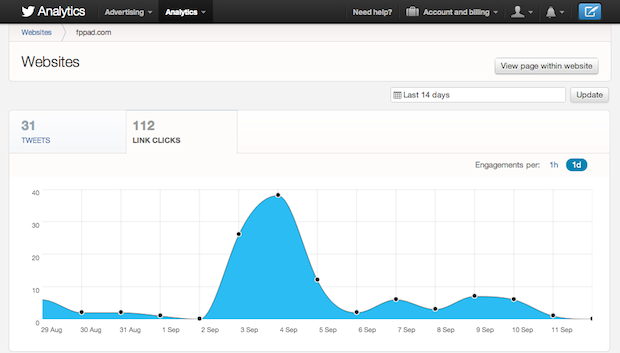

[Switching gears now, a lot of you have asked me how you can create and post videos online to market your firm and generate organic search traffic to your business. But when you post videos online, you need to know that other people with dubious intentions can steal your videos and use them for their own benefit.

This week I discovered two episodes of Bits and Bytes had been reposted to another channel on YouTube and were being used to generate advertising revenue for that channel owner. So what can you do if you find someone allegedly infringing your copyrighted videos? YouTube makes it very easy to file an infringement claim, and when I filled one out for the two Bits and Bytes videos that were stolen, YouTube removed them in less than 24 hours.

Here is the link to access the YouTube Copyright Infringement Notification form.] Content thieves are stealing popular advisor videos to draw visitors to their questionable channels. Find out how to stop them.

Orion Advisor Services, LLC Achieves ISO 27001 Certification from PRNewswire.com

[Finishing up this week’s broadcast is a security update from Orion Advisor Services, the nation’s largest privately held portfolio accounting service bureau and, full disclosure, past sponsor of Bits and Bytes. Earlier this week, Orion announced that it achieved the ISO 27001 certification for meeting rigorous standards required for internal security controls.

The ISO 27001 certification is not easy to achieve, as the audit process is both time consuming and expensive. Orion becomes just the second company in all of Nebraska to receive the certification and joins industry heavyweights like Salesforce and Broadridge as the few financial services firms that are ISO 27001 certified.

But if you seek the gold standard in security controls from your vendors and providers to keep your information safe, ISO 27001 is the benchmark that distinguishes the top companies from all the rest.] Orion Advisor Services, LLC, a premier portfolio accounting service provider, recently completed an independent audit in accordance with the global security certification standards outlined by the ISO/IEC 27001:2005 report (“ISO 27001”).