Fidelity selects External IT to deliver a “first-of-its-kind solution” to advisers

In a press release today, Fidelity announced it has selected External IT as the exclusive provider of a cloud-based virtual desktop solution to financial advisers.

The Cloud Virtual Desktop

Advisers who custody client assets with Fidelity Institutional Wealth Services® (IWS) will soon leverage External IT’s technology known as the OS33 Portal Desktop.

According to Ed O’Brien, head of technology for Fidelity IWS, pricing for the virtual desktop will be approximately $150 per user per month.

Native, Not Watered-Down

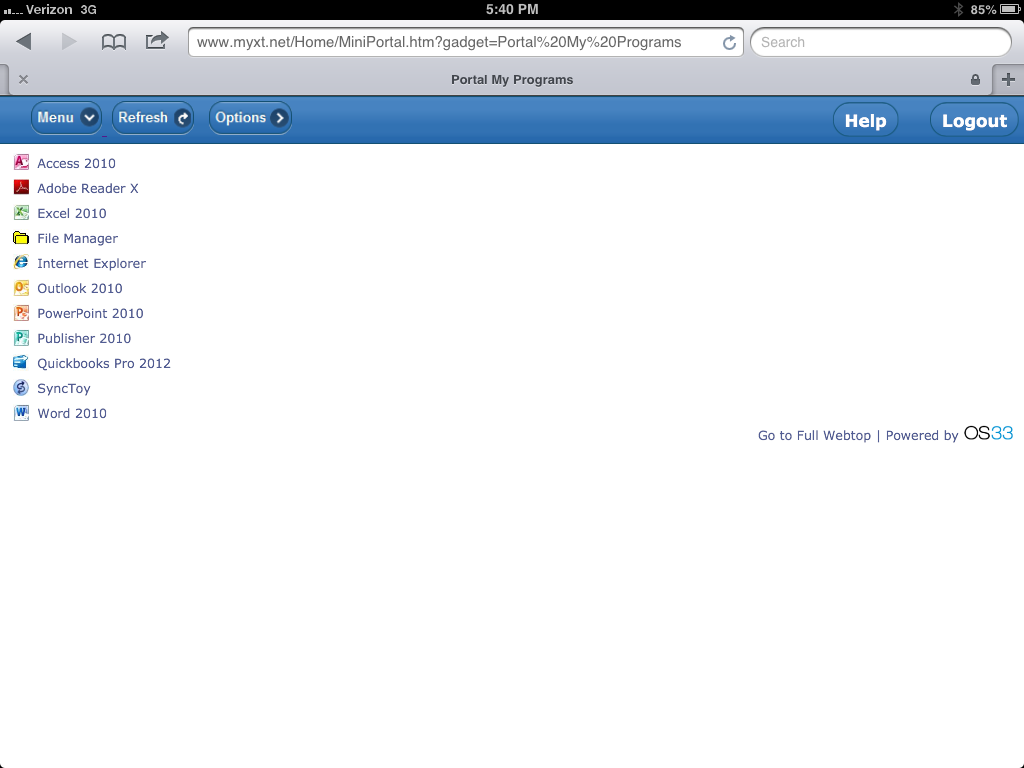

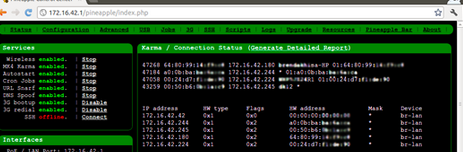

In the virtual desktop solution, advisors will find familiar programs including Adobe Acrobat, the Microsoft Office 2010 suite, Quickbooks and more.

External IT users get access to full versions of the office productivity software through Citrix Receiver, not scaled down web-based counterparts with limited functionality.

The External IT dashboard with office productivity programs included (click to view full size image)

File Access

The virtual desktop also supports traditional file management, accessed in two ways.

First, a file manager interface can be accessed directly within the web browser, allowing users to browse a file directory structure similar to those found in most computer operating systems.

The alternate file access method actually launches a separate file manager window that looks just like the Windows 7 file explorer. Users can browse files and folders in both the hosted file system as well as their local hard drive using the External IT file manager window. Worth noting is that the search field works in this separate file manager window just as it does in the native Windows 7 operating system, so users may find this method a bit faster to find documents and files.

Mobile

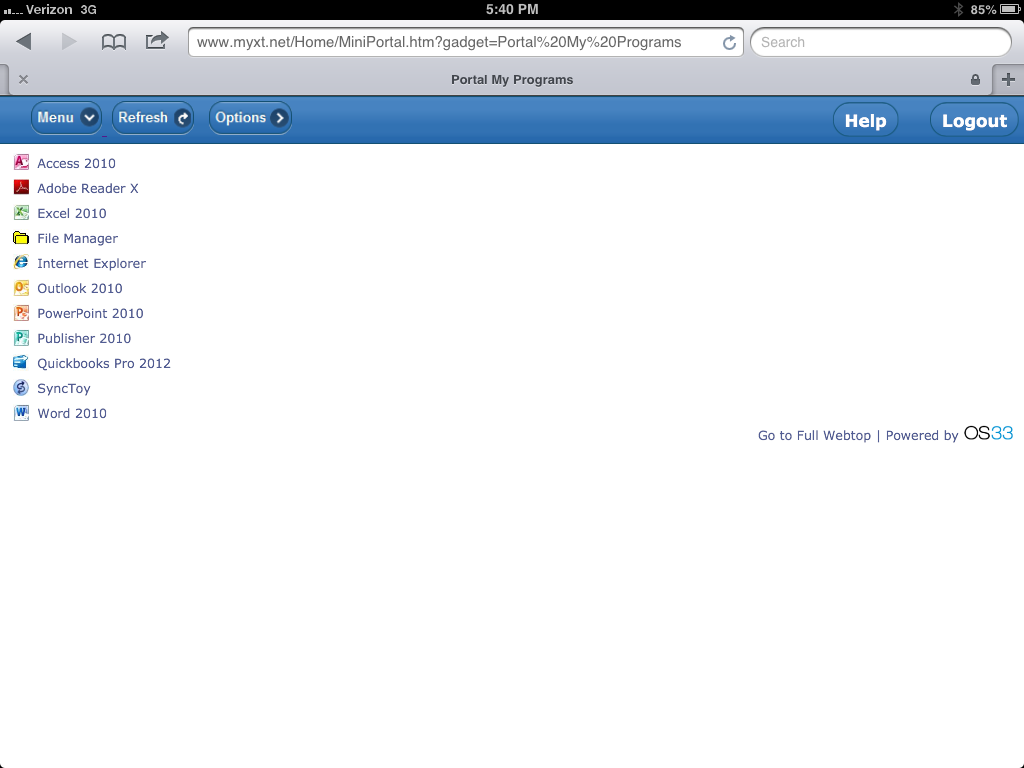

The External IT solution is also accessible from mobile devices using the standard mobile web browser. Users have a few options when working with office files like Word, Excel, and PowerPoint documents.

The mobile optimized External IT dashboard, viewed on an iPad (click to view full size image)

First, the full versions of Office programs can be streamed to the mobile device using the Citrix Receiver app. However, most will find that attempting to touch menu bars and manipulating the cursor is challenging on non-touch optimized software.

Therefore, if users have appropriate permissions, Office documents can be downloaded and opened in third party apps such as QuickOffice Pro HD or Office² HD. Changes can then be uploaded back into the External IT solution.

Security

Advisers will also benefit from a wide array of security features available in the External IT solution. Users can easily add and delete (aka provision) employee accounts, prohibit file downloads onto personal devices, and enforce multi-factor authentication when users log in.

Reactions

For reaction on the solution announcement, I reached out to several providers of virtual desktop solutions for those in financial services.

Wes Stilman, CEO of Right Size Solutions. “If the custodian desires, it provides an opportunity to integrate their technology with a cloud provider.”

“If the custodian desires, it provides an opportunity to integrate their technology with a cloud provider. For example, it could simplify single sign on,” said Wes Stillman, president of Right Size Solutions.

“The potential negative for the custodian is that the cloud provider has to earn consistent high marks,” added Stillman. “Should the quality of service falter, it could reflect badly on the custodian.”

For this reason, Fidelity arranged dedicated support for advisers from External IT and also aligned support times with the equity and bond market schedule, according to O’Brien.

O’Brien added that advisers always have access to the online External IT help desk and can also call in for support during both peak and non-peak hours.

![Ryan Terwedo, founder and CEO of CloudRIA: "Depending on how they are providing the [virtual desktop] window, the user experience is not great."](http://fppad.com/wp-content/uploads/2013/02/CloudRIA-300x170.png)

Ryan Terwedo, founder and CEO of CloudRIA: “Depending on how they are providing the [virtual desktop] window, the user experience is not great.”

Ryan Terwedo, founder and CEO of

cloudRIA, agrees with Stillman’s sentiment of the provider’s service quality, including the user experience.

“Depending on how they are providing the [virtual desktop] window, the user experience is not great,” said Terwedo. “Microsoft Word was never designed for anything but being installed on a local windows machine.”

![Ryan Terwedo, founder and CEO of CloudRIA: "Depending on how they are providing the [virtual desktop] window, the user experience is not great."](http://fppad.com/wp-content/uploads/2013/02/CloudRIA-300x170.png)