This week, a registered rep’s YouTube video on annuities lands him in hot water.

My lesson learned from this week: Completely block out a few days each month in my calendar for rescheduling events. Things don’t always go according to “plan,” so it’s a lot easier when I have a few unscheduled days available in the future rather than try and compress existing commitments to squeeze in a rescheduled event.

Here are this week’s stories of interest:

YouTube Annuities Videos Lead To Fine And Suspension from Forbes.com

[So a registered rep for First Heartland Capital, Inc., Ralph William Hicks Jr., created and posted videos to YouTube about equity index annuity (“EIAs”) seminars. FINRA alleged that Hicks’ marketing materials, including the YouTube videos, “presented oversimplified claims which omitted material information, or failed to provide a sound basis for evaluating the facts.” So what’s your lesson in all of this? If you’re going to market on YouTube (or any online site), you’d be better off avoiding specific details about products, including annuity guarantees and risks, and rather address general financial planning principles or opportunities NOT linked with particular products. But if you do mention products, you probably ought to provide a conspicuous link to disclosure material at a minimum.] While registered with First Heartland during approximately 2009 through 2011, the AWC alleges that Hicks disseminated to some 200 to 1,000 members of the public: advertising and sales literature to the public in YouTube videos; invitations to seminars and workshops; and letters concerning, among other things, bonus incentives.

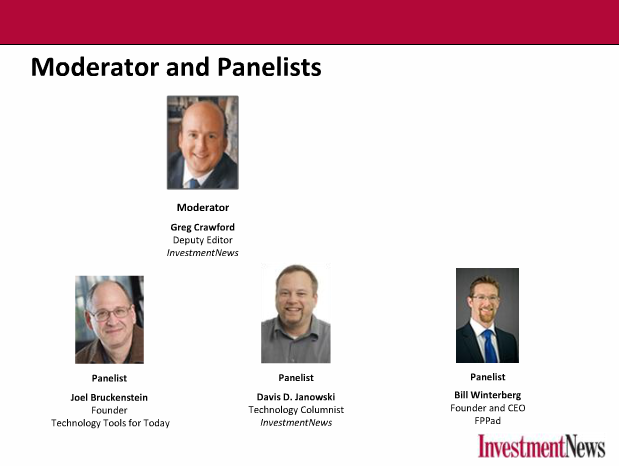

Book Review: Technology Tools for Today’s High-Margin Practice from the Journal of Financial Planning

[Bruce Colin, CFP® provides an honest, unbiased review of the new edition of Technology Tools for Today’s High-Margin Practice, updated by Joel Bruckenstein and David Drucker featuring multiple contributions from a variety of authors (of which I am one). Read Colin’s review for the best chapters of the book and why this edition is “required reading” for advisers. You can buy a copy using this affiliate link or just search for it on Amazon.] Required Reading for Tech-Savvy Planners: Latest Drucker-Bruckenstein book disappoints in some areas, but still worth the investment.

Technology blueprint for a typical RIA firm from InvestmentNews.com

[Nexus Strategy founder Tim Welsh makes a (first?) guest appearance at InvestmentNews to cover the programs and applications most used by financial advisers. Data for this article was obtained from the 2013 InvestmentNews Technology Study. But one opportunity for improvement: avoid burying the lead.] The overwhelming success of the independent-adviser segment is transforming the financial services industry. With over $2 trillion in assets, independent registered investment advisers continue to be the fastest-growing segment and as a result are attracting investments by technology firms to penetrate this growing marketplace.

Biggest Tech Trends Now from Financial-Planning.com

[In this recap of February’s Technology Tools for Today conference, Joel Bruckenstein covers the biggest trends observed: data security for financial advisers, protecting mobile devices, ramped-up custodian technology, touchscreen interfaces, and Windows 8.] The interest in security among independent advisors seemed to have ratcheted up. Perhaps it’s because major custodians have acted to heighten advisor awareness of attacks, or it could be increased media coverage of Chinese hackers targeting U.S. websites – but either way, it was one of the key questions for attendees at February’s Technology Tools for Today conference.

Salentica Releases Laser App Integration to Enable Advisors to Reduce Time Spent On Form Filling from PRWeb.com

[Streamlined form filling is almost a required technology for the progressive advisory firm. Laser App is the 800-pound gorilla in form-filling software, so it’s imperative that other technology vendors integrate with them in some way. Here’s the latest CRM integration from Salentica, the Microsoft Dynamics CRM overlay provider for financial services. They’re still tiny with respect to their user base among advisers, but supporting integrations such as this will help boost its adoption in the marketplace.] Salentica Inc., a market leader in providing innovative Client Relationship Management (CRM) and Client Reporting technology solutions for the wealth management industry, announced today the general availability of its integration with Laser App within its CRM software.

Yesterday, InvestmentNews released its inaugural 40 Under 40 project to recognize the talent, influence, and contributions of young professionals in the industry, and it is an honor to be one of the individuals on the list.

Yesterday, InvestmentNews released its inaugural 40 Under 40 project to recognize the talent, influence, and contributions of young professionals in the industry, and it is an honor to be one of the individuals on the list.