On today’s broadcast, Morningstar acquires ByAllAccounts for $28 million, how this deal might shake up the account aggregation marketplace. The SEC issues new guidance on social media and the testimonial rule. Find out what you can and can’t do online regarding client testimonials. And Wealthfront raises another $35 million in venture capital. Are you ready to take on the new technology funded by this war chest?

So get ready, FPPad Bits and Bytes begins now!

(Watch FPPad Bits and Bytes on YouTube)

Today’s episode is brought to you by My Virtual COO, a leading practice management firm that helps advisors free up time so they can devote their energy to mission critical, profitable, and enjoyable activities.

To find out how you can implement a lean operations plan, download their latest white paper titled “The Lean Solution to Becoming a More Profitable, High Growth Advisory Firm” by visitingfppad.com/myvirtualcoo

Here are the links to this week’s top stories:

Morningstar, Inc. Acquires ByAllAccounts, Inc., Provider of Innovative Data Aggregation Technology for Financial Applications from Morningstar, and

How Morningstar’s $28 million acquisition of ByAllAccounts will change account aggregation (or not) from FPPad

[Leading off this week is an announcement from Morningstar that the company just acquired account aggregation provider ByAllAccounts for $28 million. For over a decade, ByAllAccounts has been feeding, scraping, and otherwise aggregating account data for held-away 401(k)s, annuities, 529 plans, and any other accounts not held at an advisor’s custodian of choice.

Account aggregation makes it possible to generate net worth, asset allocation, and other reports that accurately reflect a client’s total portfolio, not just for those assets held with one custodian. But ByAllAccounts goes one step further by providing reconciliation-ready data, meaning advisors can import transactions into their portfolio management software of choice and actually generate performance reports for client portfolios.

The only other provider of reconciliation-ready data is Aqumulate, formerly Advisor Exchange, so essentially these two hold a monopoly in this space, leading me to wonder why ByAllAccounts would be willing to be acquired by Morningstar at this point in time. There certainly are other aggregation options from Yodlee and Intuit gaining traction among RIAs, but they only provide holding and balance information and not the reconciliation-ready data needed for performance reports.

James Carney, President and CEO of ByAllAccounts, wrote in an email to customers that “for now, it’s business as usual,” so stay tuned to see how this acquisition may alter the playing field in the account aggregation market.] Morningstar, Inc. (NASDAQ: MORN), a leading provider of independent investment research, today acquired ByAllAccounts, Inc., a provider of innovative data aggregation technology for financial applications.

Guidance on the Testimonial Rule and Social Media from SEC.gov, and

Yelp: Using a Business account from Yelp.com

[Next is an update from the SEC, who this week issued guidance number 2014-4 on the testimonial rule and the use of social media.

There’s a lot to this new guidance, but from a technology perspective, it clears the way for advisors to link their website and social media profiles to independent online review sites such as Yelp, Angie’s List, or even WalletHub.com without violating the prohibition against testimonials.

Now you can’t copy and paste select reviews from those sites and post them to your website. You have to copy all of the reviews together, but that requires too much ongoing maintenance to keep up to update.

Instead, you can embed widgets from sites like Yelp that display your average rating from all reviews, and since those widgets stay updated in real time, there’s no ongoing maintenance required on your part once you’ve embedded the code on your website.

Also, the SEC’s guidance clarified that you can include a partial list of clients on your social media profiles without triggering the testimonial rule, as long as the list doesn’t highlight your client’s experience or endorsement of you as an advisor.

Just take a look at Wealthfront’s website, which was just updated to include photos of sixteen influential investors from Silicon Valley. You can employ the same tactic if you think posting photos of some of your clients online will help you win future business.

And how does the new guidance affect LinkedIn? It’s clear that LinkedIn recommendations and endorsements still remain off limits to advisors, as you control what does and does not appear publicly next to your profile. That control can lead to cherry picking recommendations which is a definite no-no under the SEC’s guidance.] From time to time, we have been asked questions concerning the nature, scope and application of the rule that prohibits investment advisers from using testimonials in their advertisements.

Automated Investment Service Wealthfront Raises $35M From Index, Ribbit Capital from TechCrunch

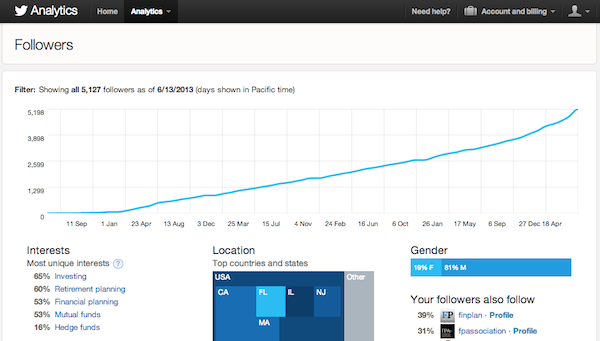

[And speaking of Wealthfront, this week’s final story highlights the automated investment service’s latest round of venture capital, as the company raised $35 million led by Index Ventures and Ribbit Capital. Wealthfront also updated its Form ADV Part II as the company now manages over $800 million in assets on behalf of its users.

This brings the company’s total funding to $65 million, surpassing Personal Capital’s $54 million, which is a significant war chest to pay for additional development and new tools and techniques to further reduce the cost of managing investment portfolios. This places even more pricing pressure on advisors who charge high fees exclusively for their own investment management services and nothing else.

So if you’re not making investments in your own technology, or don’t clearly differentiate how the services you offer involve a lot more than just investment management, the time to start doing so it right now.] Financial services as an industry is a sector that is rapidly being disrupted from all directions.

And here are stories that didn’t make this week’s broadcast:

Smarsh Sites Delivers Professional, Modern Websites for Financial Services Professionals from BusinessWire.com

Smarsh®, the leading provider of hosted archiving solutions for business communications, today announced the launch of Smarsh Sites, the new website hosting and production platform optimized for the financial services industry.

Watch FPPad Bits and Bytes for April 4, 2014