04/11/2013: Updated to clarify a LOT of my own confusion surrounding Salentica and Microsoft Dynamics CRM.

Microsoft Dynamics CRM comes in so many variants with and without third-party providers, I find myself scratching my head when trying to figure out the maze of buying the product, let alone use it.

I was saving this for Friday’s Bits and Bytes update, but as I started digging into the story, I found myself navigating a rabbit’s hole of strange logic.

If I’m confused about Microsoft Dynamics CRM, then I think you don’t stand much chance keeping this all straight on your own!

This story all started with the following press release:

Salentica Releases Schwab OpenView Gateway™ Solution for Microsoft Dynamics CRM Users from PRWeb.com

Ok, stay with me on this one.

Who is Salentica?

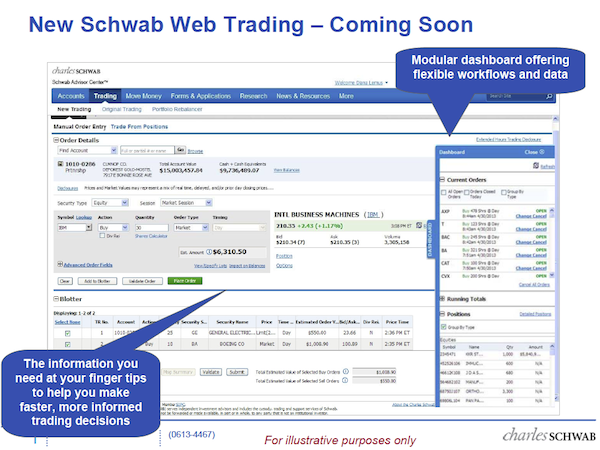

Salentica is a reseller Microsoft independent software vendor (ISV)/ Microsoft Certified Partner, and they provide a custom overlay to Microsoft Dynamics® CRM specific to financial advisers called Salentica CRM. If you use Salentica CRM and custody with Schwab Advisor Services, you’ve been able to use Schwab OpenView Gateway™ to get real-time data from Schwab populated in Salentica CRM for about six months.

Great!

Wait. ISV vs. Reseller?

I was mistaken about Salentica’s role as a reseller. They’re an ISV. What’s the difference?

An ISV sells software they created that runs on a particular platform. In this case, Salentica CRM runs on Microsoft Dynamics CRM, but you don’t buy Dynamics from Salentica. You have to buy your Dynamics licenses from either Microsoft (for Dynamics in the cloud) or a reseller (for Dynamics on-premises or in a partner-hosted environment).

A reseller adds custom features and (very commonly) services to a particular product, then resells it as an all-in-one solution. This is how the Laserfiche document management product is sold. Advisers (excluding the very large multi-office multi-billion RIAs) typically buy Laserfiche from a value-added reseller (VAR), not from Laserfiche itself. Licensing, billing, customization, support, and more is entirely administered by the VAR.

Standalone Microsoft Dynamics CRM

But maybe you don’t use Salentica CRM, and instead have your own license of Dynamics CRM. You don’t get Schwab data. Well, Salentica just announced the general release of Schwab OpenView Gateway™ for Microsoft Dynamics® CRM, so now users of plain-vanilla Microsoft Dynamics CRM 2011 can also get real-time data from Schwab via Schwab OpenView Gateway!

Clear?

Not so Clear

Wait.

Microsoft Dynamics CRM comes in lots of versions, two of which primarily apply for advisers. Microsoft Dynamics CRM 2011 is the on-premises version installed locally on a computer, OR it can be in the cloud using a partner-hosted environment.

Microsoft Dynamics CRM Online is the cloud version that retails for $44/user/month. It can be combined with Office 365 (which alone typically runs $150/year/user if you want the Small Business Premium version that supports desktop Word, PowerPoint, Excel and more). So you’re looking at just under $200/month/user for retail pricing for Office 365 and Dynamics CRM. Microsoft Partners may offer lower pricing, but you get the general idea of cost.

So, if you’re using Microsoft Dynamics CRM Online (with or without Office 365), then you’re out of luck with respect to real-time data via Schwab OpenView Gateway.

If you want Dynamics in the cloud with Schwab OpenView Gateway integration, you first have to use Dynamics in a partner-hosted environment, THEN you have to use the new solution from Salentica mentioned in the above press release.

But wait. If your partner-hosted environment comes from Tamarac, you can’t integrate with Schwab OpenView Gateway today. Not yet, at least. A solution is coming soon.

The Salentica solution mentioned in the press release only works with Microsoft Dynamics CRM 2011, whether it be an on-premises version or in a partner-hosted environment (minus Tamarac for the time being).

How to Buy? See a Reseller

I can’t even figure out how to buy the on-premises CRM version from Microsoft. It turns out you can’t. You have to work exclusively with a third-party reseller to get it.

So, say you happen to ask Salentica about buying Microsoft Dynamics CRM 2011 for an on-premises CRM. Won’t you just get “upgraded” to Salentica CRM that already features the OpenView Gateway integration? No separate solution required.

So why bother releasing this new solution for Microsoft Dynamics CRM 2011 users?

It turns out that there are customers who purchased Dynamics CRM from a reseller/Certified Partner and also want to connect it with Schwab OpenView Gateway. Pareto Platform CRM customers are a great example. How many potential customers fit this criteria, I don’t know. It can’t be more than a few hundred. Can it? But evidently there are enough for Salentica to build a solution for them.

My Digression on Press

So in the strikeout section below, I went off on a tangent about the Salentica press release potentially not being news. Clearly I didn’t understand the fact that there are users out there with Dynamics they bought from a reseller (Tamarac keeps coming to mind) but can’t integrate it with Schwab OpenView Gateway.

Salentica’s solution is new, and now those users do have an option to integrate Schwab OpenView Gateway data into their CRM.

Subscribing to Salentica’s new solution costs $120/user/year.

So a thought just occurred to me: maybe this is just press for press’ sake, and there’s really nothing new here.

I found it odd that news of a new custodial integration came from the third-party provider rather than the custodian. Why would that happen? Wouldn’t the custodian also want to take some credit and boost their marketing profile with some news as well?

Perhaps if the “news” really isn’t news, then I can begin to understand why the custodian didn’t also jointly release their own marketing material. There’s no story.

But, take note, Schwab Intelligent Integration’s last press release is dated November 2012. Not exactly breaking news. But I digress.

(Salentica president Bill Rourke called me out for writing “tiny fraction” below. His response was that Salentica is the largest provider of Microsoft CRM for independent advisers. I get that. Only Microsoft CRM continues to fair poorly in financial adviser technology surveys, including Financial Planning’s 2012 survey (3%) and InvestmentNews’ 2012 survey (4.4%).)

If you’re one of the tiny fraction single-digit percentage of all advisers using Microsoft Dynamics CRM powered by Salentica feeding in data over Schwab OpenView Gateway, can you care to leave a comment on how well its working and how it’s helped your business?

Because I feel a little in the dark.