Innovative dashboard for portfolio rebalancing is now a patented method

Innovative dashboard for portfolio rebalancing is now a patented method

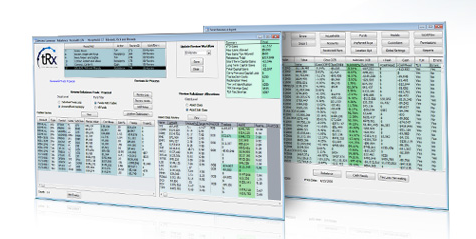

Last year I connected with Total Rebalance Expert (TRX) CEO Sheryl Rowling to learn about the rebalancing software for advisers. In our discussion, Rowling highlighted the innovative Analysis Expert dashboard for which TRX filed a patent.

Watch the video interview from T3 2012 about the patented technology (starts at 3:05): http://youtu.be/JrpKkRuxok8?t=3m5s

Now, TRX just announced that it attained US Patent 8,321,320, granted November 27, 2012 for “Portfolio Management Analysis System and Method.”

“Advisors have been telling us all along that our approach to providing the needed technology to automate the portfolio rebalancing process was unique and innovative,” said Cheryll Lurtz, TRX co-founder and CIO, in a press release.

“Now with this patent, advisors using TRX can uniquely benefit from that intellectual capital that was generated from the experiences in tax-efficient rebalancing developed in advisory practices,” added Lurtz.

Click here to view the TRX press release (43 Kb PDF)

Frequent readers know I’m an advocate of

Frequent readers know I’m an advocate of