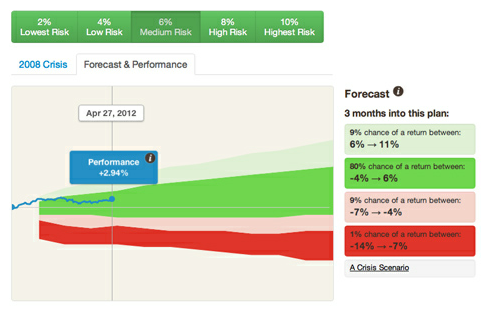

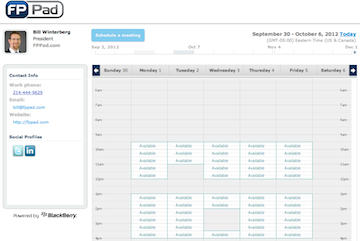

My Tungle.me calendar

Update, August 2016: I added Assistant.to, a slick Chrome plugin that works only with personal and corporate Gmail and Google Calendar accounts.

With a hat tip to Atlanta-based adviser Russ Thornton, I learned that Tungle.me, my go-to public calendar service, announced today that it is shutting down in December.

See the Life is About the Journey post from Tungle founder Marc Gingras on the company blog.

Sad but not surprising

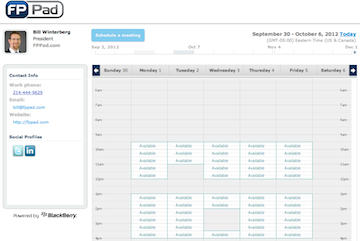

This is a big disappointment, but it is not unexpected. Ever since being acquired by Research In Motion (the makers of BlackBerry mobile phones) in April 2011, Tungle’s blog and Twitter feed went silent, and customer service stopped responding to inquiries, mine included.

Still, over the two years that I used the service (see A Simpler Way to Schedule Meetings at Morningstar, login required), I booked well over 200 meetings and avoided unnecessary correspondence.

Why advisers need a public calendar

In my Transformative Technology You Can Implement Today presentation, I demonstrate how financial advisers can stop playing “email Battleship” when attempting to schedule meetings.

Instead of the constant back-and-forth emails trying to lock down a time that works for all those involved in a meeting, public calendar services allow one or more attendees to draw in the times they are available, and everyone receives a confirmation when a time is identified that all can attend. No more “how does Tuesday at 1pm work for you?” volleys.

Tungle alternatives

Never one to leave FPPad readers out in the cold, here are some free and low-cost alternatives to Tungle worth investigating. I’m not making any one specific recommendation now, but will soon have to switch my own public calendar over to one of these services (now sorted with the most recently modified first).

- Assistant.to (added August 2016, works only if you have personal and corporate Gmail and Google Calendar accounts. Recipients don’t need to use Gmail)

- Bookings from Microsoft (announced in July 2016, it’ll rolling out slowly to Office 365 Business Premium subscribers who are in the First Release program)

- vCita Online Scheduling (added June 2015)

- Doodle (this is the service I used up to March 2015, but they’re going to charge $39/year for online calendar connections. Be sure to watch my interview with Doodle founder Myke Naef)

- TimeBridge (it was dead as of 2014 for all intents and purposes, see this Quora question, but it’s coming back to life in 2016! Read this, also on Quora)

- Timebird, (added April 2014 from a comment below by Dan Nielsen)

- Calendly.com (added September 2013, see comments below)

- ScheduleOnce

- Bookeo

- Acuity Scheduling ($10/month for single user Google synchronization, see Sharon W’s comment below)

- TimeTrade (recommended by Chuck Hammond via Twitter)

- Book’d (currently in private beta)

- Meetin.gs (There’s a lot to this service, but I think they have an online scheduling page)

- Meetifyr (I already don’t like the user interface on this one!)

Have any others to recommend? Leave a comment below.

Last month Tungle announced they’re shutting down their popular public calendar and scheduling service (see:

Last month Tungle announced they’re shutting down their popular public calendar and scheduling service (see:

In response, Dropbox said

In response, Dropbox said