Betterment gives financial advisers access to its popular low-cost, automated online investment solution

Betterment gives financial advisers access to its popular low-cost, automated online investment solution

FPPad Quick Take:

- Financial advisers can now offer Betterment Institutional as a white-labeled low-cost online investment service to emerging clients.

- Betterment Institutional charges 25 basis points a year, advisers can charge an additional fee if they wish

- Fidelity Institutional Wealth Services will list Betterment Institutional as a practice management solution in its list of resources for advisers

Betterment, a popular automated online investment service, today announced the expansion of its technology for use by financial advisers and an inclusion among Fidelity Institutional Wealth Services practice management solutions.

Betterment for Advisers

Betterment Institutional is an expansion of the startup’s popular online investment service built for retail investors. As of June

10, 2014, Betterment reported $613,372,319 in assets under management in its regulatory filings.

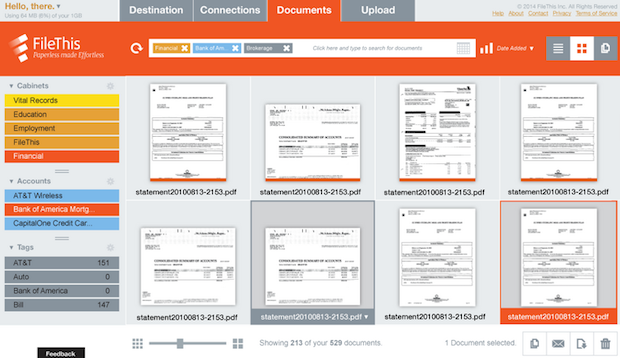

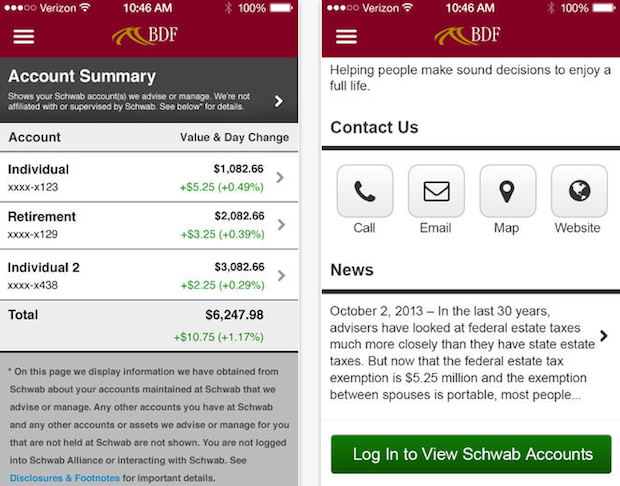

According to Nick Gavronsky, product manager for Betterment, the company’s new offering allows financial advisers to white label the Betterment Institutional offering and brand it for their own business. Advisers using Betterment Institutional will receive a website hosted by Betterment that investors can use to create accounts, view statements and engage with an adviser.

Initially, end clients using Betterment Institutional will use the company’s Android and iOS mobile apps as they exist today, but adviser-branded apps are anticipated to be phased in as the offering matures, Gavronsky said.

Low Cost Investments

Betterment Institutional will allow financial advisers to set their own fee schedule for clients who choose to use the service. Betterment collects an annual fee of 25 basis points (0.25%) from accounts on the Institutional platform, and any additional fees above that amount are paid to the adviser.

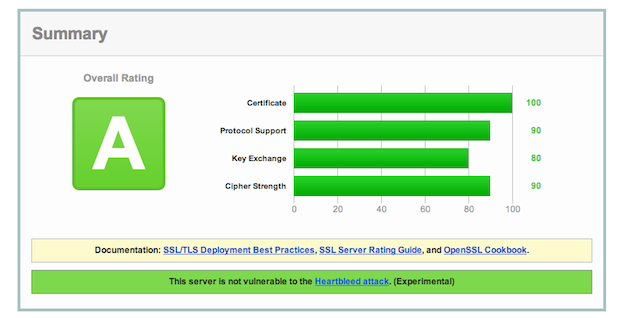

Just as with the retail Betterment offering, accounts are held by Betterment LLC, an SEC Registered Investment Adviser, and securities transactions are cleared through Apex Clearing Corporation.

Custom Models Welcome

Investors using Betterment’s retail offering are familiar with the standard asset allocation models the company’s algorithms select for clients based on their answers to a risk tolerance questionnaire.

Betterment Institutional offers the same investment allocation models to financial adviser clients, but the company also permits advisers to create their own custom models.

Again, the same technology that powers the default models in Betterment’s retail platform is available to custom investment models created by advisers, Gavronsky said in an interview.

In addition, investors who have $50,000 or more managed with Betterment Institutional have access to the same Tax Loss Harvesting+™ feature found on the retail Betterment platform. Tax Loss Harvesting+™ is an automated, daily account rebalancing feature.

Fidelity Touts Practice Management

Also noteworthy in the Betterment Institutional announcement is the recognition that Fidelity Institutional Wealth Services, providing custody services to nearly 3,000 RIAs, now includes Betterment Institutional as one of the practice management solutions Institutional Wealth Services offers to its RIA clients and prospects, according to Erica Birke, vice president of communications and corporate affairs for Fidelity Institutional.

“Fidelity Institutional Wealth Services and Betterment share an interest in helping advisors realize that digital advice should not be perceived as a threat, but rather an opportunity to evolve their engagement models to better attract new business segments, particularly the emerging affluent, a segment that many advisory firms have historically under-served or not served at all,” wrote Birke in an email.

Fidelity does not have exclusivity over the Betterment Institutional offering to advisers; any adviser is free to engage Betterment Institutional as he or she wishes.

Financial Adviser Value

Betterment Institutional joins Upside Advisor and Guide Financial in an effort to provide a low-cost automated investment solution to financial advisers.

Upside Advisor recently made headlines by powering Liftoff, the low-cost investment solutions offered by high profile New York RIA Ritholtz Wealth Management. Liftoff offers a similar model portfolio management service for an annual fee of 40 basis points (0.40%).