On today’s broadcast, LPL Financial hooks up with BlackRock’s FutureAdvisor, Riskalyze and Advizr integrate their platforms, and bots might be the future of financial technology.

So get ready, FPPad Bits and Bytes begins now!

(Watch FPPad Bits and Bytes on YouTube)

Today’s episode is brought to you by Twenty Over Ten, providers of beautiful, tailored, mobile responsive websites specifically for Financial Advisors.

Easily manage your brand while automatically archiving your website changes for compliance. Sign up for a 45 day free trial today by visiting twentyoverten.com/fppad. Oh, and be sure to watch the YouTube channel for videos from next week’s NAB Show, which are also brought to you by Twenty Over Ten.

Here are the links to this week’s top stories:

LPL Financial to Leverage BlackRock Solutions’ FutureAdvisor to Offer Robo Solution to Advisors and Their Clients from LPL Financial

[Now on to this week’s top story which comes from LPL Financial, as the nation’s largest independent broker-dealer announced it will use BlackRock’s recently-acquired FutureAdvisor platform to power an online automated investment offering. LPL first hinted at its plans for a “robo advisor” back in the summer of 2015 at its annual Focus conference, which was roughly one month before BlackRock made its FutureAdvisor acquisition.

While the announcement sure generated some buzz, no details on specific pricing or availability were provided. What the press release did say is that the model portfolios will be provided by LPL’s research department, so at least initially, advisors and reps will not be able to create their own custom allocations.

The press release also said the automated solution will be integrated with LPL’s custodial platform, but it didn’t say if that was the existing BranchNet platform or the much-anticipated ClientWorks, which as far as I know, has still not been officially released.

So at least we now know what LPL’s robo strategy will be, but with so many forward-looking statements, we don’t know when that strategy will be ready for use by LPL’s financial advisors.] Leading retail investment advisory firm and independent broker/dealer LPL Financial LLC, a wholly owned subsidiary of LPL Financial Holdings Inc. (NASDAQ:LPLA), today announced it will use BlackRock Solutions’ (BRS) FutureAdvisor platform to support a digital advice platform for use by LPL’s financial advisors and institutions and their clients.

A Match Made in Heaven: Advizr and Riskalyze Integrate from Businesswire

[Next up is news from Riskalyze and Advizr, as the two companies announced a new integration to streamline financial advisor workflows. The new integration will import Riskalyze model portfolio sets into the Advizr financial planning software, allowing advisors to recommend the most appropriate asset allocation according to their client’s personal Risk Number.

Not only that, both companies offer effective lead generation tools for advisors, with Riskalyze offering prospects the opportunity to determine their own Risk Number, and Advizr offering a quick financial plan illustration with Advizr Express.

The combination of the two will help advisors gain more information about prospects’ risk tolerance and the building blocks of a complete financial plan.

The companies called the integration “a match made in heaven” because both of them are winners of the Best Client Facing Technology award announced right here on FPPad.

So as a result, and I am now officially accepting endorsements for matchmaking on my LinkedIn profile.] Advizr, the financial planning software recognized as the Best Client Facing Technology of 2015 by Bill Winterberg’s FPPad, and Riskalyze, the world’s first Risk Alignment Platform recognized for the same award in 2014, are integrating their award-winning products to provide an elegant, intuitive and seamless solution to financial advisers.

Messenger Platform at F8 from Facebook.com

[And finally, this week’s top story comes from the future, oh wait, “THE FUTURE!” as Facebook CEO Mark Zuckerberg took the stage at this week at F8 conference and detailed the company’s roadmap for the next 10 years.

My best takeaway for you is the launch of the Messenger Platform that includes automated messaging powered by bots, no, not that bot, these are automated messenger bots.

With bots in messenger, you can make online clothing purchases, receive weather forecasts, view top headlines and more.

I can totally see bots making their way into your technology. Imagine if you could ask your Redtail bot when you next client meeting is scheduled, or your Orion bot how your AUM has grown over the past year, or even allow clients to ask the MoneyGuide Pro bot for their updated retirement confidence meter. How cool is that?!?

And if vendors eventually integrate bot into existing services, I bet that they’ll also include message archiving and retention so you can confidently use bots without violating your compliance requirements.

Oh, did I just give those vendors a little more work to do? I’m sorry!

Unfortunately there’s no word yet from FINRA or the SEC whether your bot has to be fingerprinted and subject to a background check. Thank you, I do two shows a night!] We’re excited to introduce bots for the Messenger Platform. Bots can provide anything from automated subscription content like weather and traffic updates, to customized communications like receipts, shipping notifications, and live automated messages all by interacting directly with the people who want to get them.

Here are stories that didn’t make this week’s broadcast:

Former Top Schwab Executive Joins Betterment Board from New York Times

Less than one month after an investment round that doubled its private valuation to around $700 million, the robo-adviser Betterment is adding a former top executive from Charles Schwab, John S. Clendening, to its board.

Find time for your goals with Google Calendar from Google

That’s why starting today, we’re introducing Goals in Google Calendar. Just add a personal goal—like “run 3 times a week”—and Calendar will help you find the time and stick to it.

Orion’s Integration of FactSet’s Robust Research and Analytics Allows Advisors to Better Serve Their HNW and Institutional Clients from Marketwired

Orion Advisor Services, LLC (“Orion”), a premier portfolio accounting service provider for financial advisors, has announced it is now integrated with FactSet, a leading provider of financial data, analytics, and service, to offer its advisor clients easy access to portfolio research and analytics.

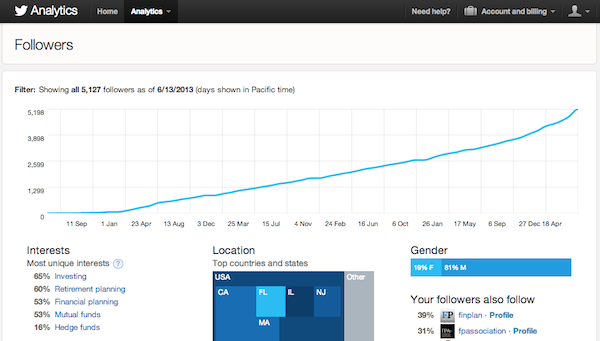

So you decided to dip your toe in the social media waters. At first you start with, say, a LinkedIn profile update, then create your own Facebook page, and follow up with your first tweet on Twitter.

So you decided to dip your toe in the social media waters. At first you start with, say, a LinkedIn profile update, then create your own Facebook page, and follow up with your first tweet on Twitter.